Mandatory Electronic Invoicing in Vietnam

Learn how to get your company ready to exchange documents in accordance with Vietnamese requirements with the support of Comarch

Learn how to get your company ready to exchange documents in accordance with Vietnamese requirements with the support of Comarch

E-invoices have been mandatory in Vietnam since July 1 2022 for all taxpayers. The system promises to save time and money, which will contribute to greater efficiency of businesses and tax authorities.

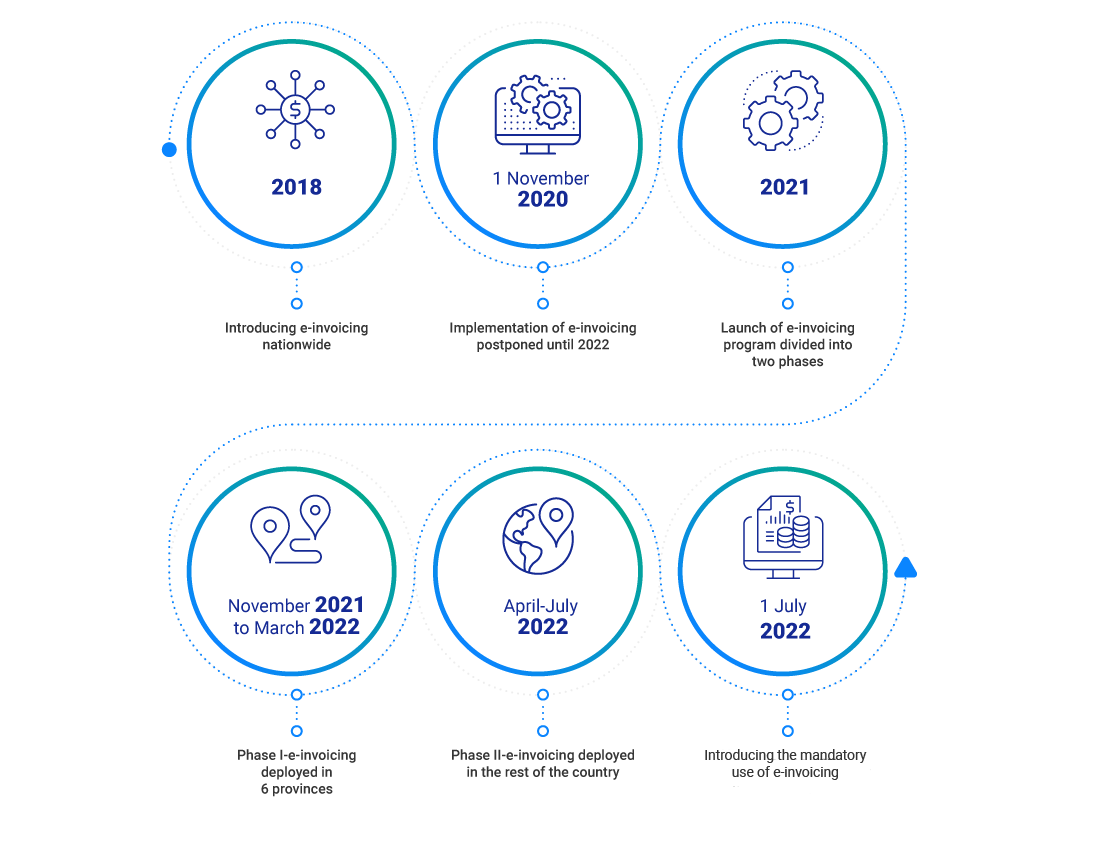

All businesses must issue e-invoices to buyers, digitally report all their transactions to the tax authority (GDT), and register (on the GDT website) before using e-invoices, in order to obtain approval from the General Tax Department (GDT). Guidelines for the development of e-invoicing in Vietnam are set out in circular 78/2021/TT-BTC issued by the Ministry of Finance, which concerns the development of e-invoicing implementation under Regulation 123/2020/ND-CP as well as several other regulations, including technical and infrastructural ones. The implementation of e-invoicing was gradual, and has been optional in Vietnam since 2011. As a first step, the General Tax Department (GDT) implemented the e-invoicing rollout plan in a two-phase nationwide pilot, encouraging businesses that were ready to switch to e-invoicing to apply early and start the implementation process.

There are two forms of invoices in Vietnam: with and without verification codes. Coded invoices are mainly used by companies with an annual turnover of less than VND 3 billion, while unencrypted e-invoices are issued by small businesses with an annual turnover of more than VND 3 billion or fewer than 10 employees, and industries such as energy, telecommunications and e-commerce.

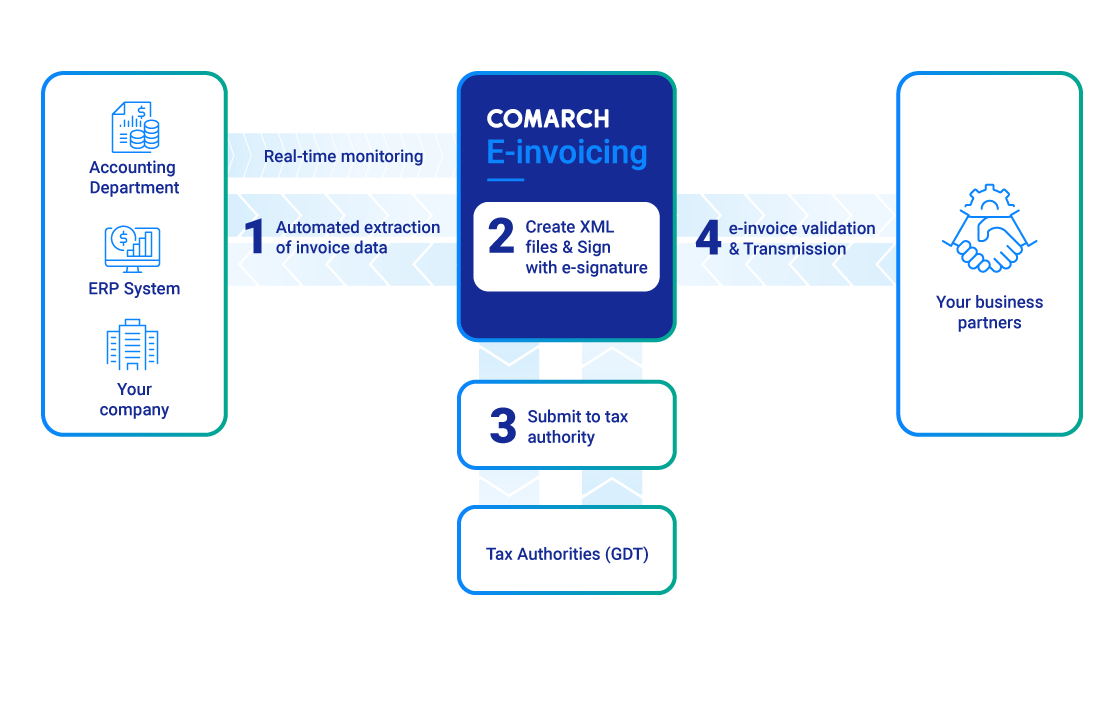

In Vietnam, companies must submit e-invoicing data to the tax authorities either directly or through an authorized e-invoicing service provider. Invoices issued by taxpayers need to be transferred to the General Department of Taxation in order to obtain a unique verification code. Once received, e-invoices will be sent to buyer. Enterprises and economic organizations are obliged to use electronic invoices with tax authority codes when selling goods or providing services, regardless of the value of these goods and services, except for the cases specified in art. 91 of the Tax Law 2019 No. 38/2019 /QH14.

XML is the main e-invoice data format and contains two elements, e-invoice data and digital signature data

Mandatory is digital signature

Electronic invoices must be securely stored for a period of 10 years

We have 20+ years of experience in carrying out various EDI, e-invoicing, and other document exchange projects around the world. In those years, we have successfully connected more than 130,000 entities from over 60 countries.

Full compliance with the latest data exchange regulations and modern data transfer standards

Applying new technologies and IT solutions in order to streamline workflows and automate activities and procedures

Tailor-made solutions based on processes specific to each company – own road map and a suitable pace of changes

Highest level of security for all sensitive and important company data

To learn the e-invoicing requirements for a specific country, click on its flag and access the relevant information.

Make sure your business meets international standards with the Comarch e-Invoicing platform, trusted in more than 60 countries. Enjoy hassle-free integration and continuous compliance updates.

E-invoicing in Vietnam has been mandatory since July 1st 2022.

All businesses must issue electronic invoice to buyers, digitally report all their transactions to the tax authority (GDT), and register (on the GDT website) before using electronic invoices in order to gain approval from the General Department of Taxation (GDT).

XML is the main e-invoice data format in Vietnam and contains two elements, e-invoice data and digital signature data.