Global Compliance

e-Invoicing and e-Transport

One Platform Multiple Countries

One Platform Multiple Countries

Over the past few years e-invoicing has grown in importance like never before thanks to the digitization and modernization of economic transactions, acceleration of processes, increased data quality and faster tax settlements and the need to reduce the VAT gap. In many countries, however, it is related to being legally compliant in various forms and schemes, but it is always based on the same principle: the relevant government approves or controls data on business transactions.

Being legally compliant in practice means that the supplier or buyer comply with official regulations in a specific country when sending and receiving e-invoices in following areas:

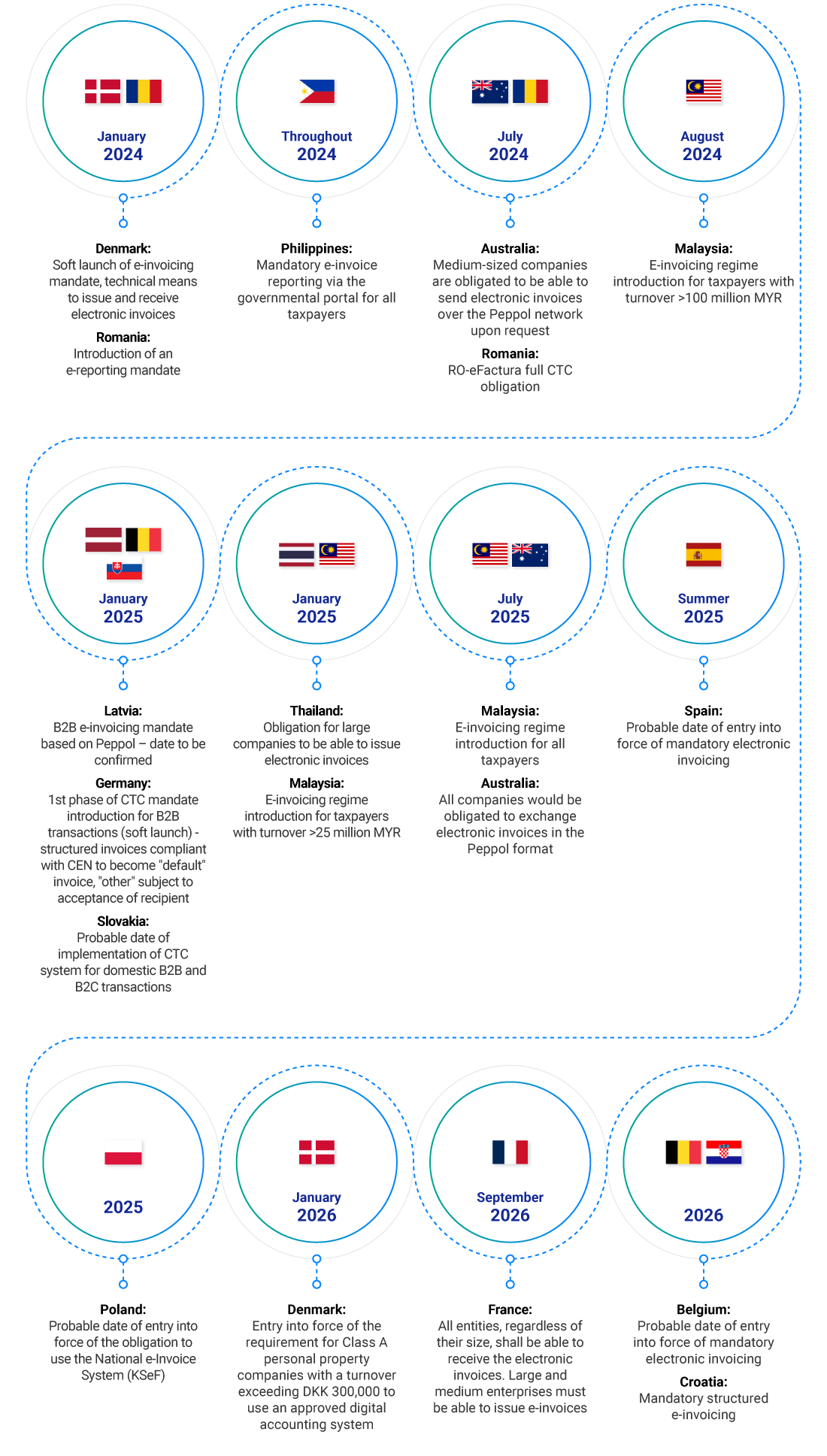

Check where the mandate is going to be introduced in the nearest future.

To learn the e-invoicing requirements for a specific country, click on its flag and access the relevant information.

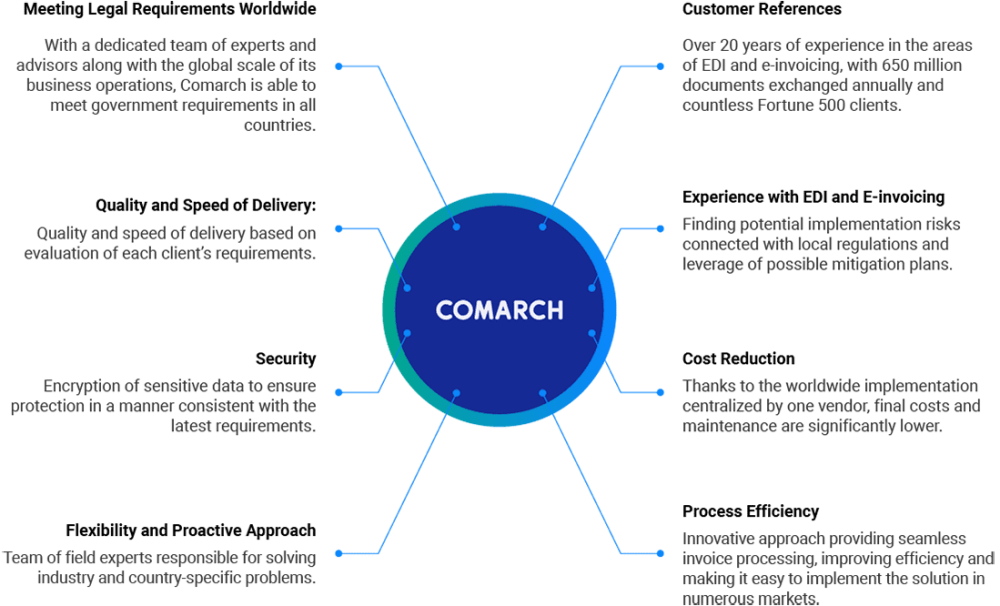

Make sure your business meets international standards with the Comarch e-Invoicing platform, trusted in more than 60 countries. Enjoy hassle-free integration and continuous compliance updates.

For years, we’ve been providing support to companies operating in countries where e-invoicing is already obligatory (such as Italy, Serbia and Turkey) and places where such an obligation is to be introduced (such as Poland, France, Spain, Germany, Romania and many others).

It means that, with Comarch e-Invoicing platform, you can exchange documents with multiple partners from all over the world using just one tool – without worrying about new and upcoming policies, no matter how many different ERPs you operate on.

Best practices based on collaboration with industry organizations and government agencies on a global scale

On 18 July 2024, the MF and the National Tax Administration held another consultation meeting on the KSeF, during which representatives of the Ministry of Finance summarised the pre-consultation of solutions to date liberalising the terms of the mandatory KSeF.

According to the latest feedback received from the Malaysian authorities, no postponement is planned regarding the implementation date of the upcoming e-invoicing mandate.

Comarch was recently accredited by the Malaysia Digital Economy Corporation (MDEC) as a Peppol Service Provider. This accreditation allows us to offer our Peppol e-invoicing solutions to businesses in Malaysia, helping them comply with e-invoicing.

Legal compliance in the context of e-invoicing refers to the activities and practices of e-invoice processing by companies in a given country, carried out in accordance with local regulations.

These regulations include country-specific requirements regarding the format of electronic invoices, the method of their exchange, which can be made directly or through the tax authority, and the period and method of archiving.

The key elements determining the legal compliance of electronic invoicing are:

It is easy to invoice a project for one company, but much more complicated when it is a global project. The biggest issue for businesses is providing legal compliance when invoicing projects globally, as each country is different. Global businesses need a global provider to navigate this. The best way is to use a centralised platform to manage conflicting regulations.

A centralised Comarch e-Invoicing platform allows invoice-related flows to be processed cost-effectively and efficiently, have a multi-lingual service desk and the ability to operate in multiple countries, processing e-invoices according to local regulations.

This includes validating content, ensuring the correct formatting of invoices and transmitting data securely while allowing authorised users to always know the invoice’s status. A centralised platform fully streamlines and automates the accounts payable and accounts receivable (AP/AR) process.