Comarch EDI Ready for Obligatory

e-Invoicing in Poland!

Learn how you can send & receive structured invoices to/from the National System of e-Invoices (KSeF) using our platform

Learn how you can send & receive structured invoices to/from the National System of e-Invoices (KSeF) using our platform

Soon, Poland will become another European Union country to change the model of electronic invoice processing from the post-audit model to the clearance model. From January 1, 2022, the KSeF (National System of E-Invoices) has been in operation in Poland and since then it has been possible to voluntarily exchange structured invoices. KSeF was introduced to enable data exchange, issuing, receiving and storing structured invoices in the area of B2B invoicing.

During a press briefing on January 19th, 2024 Poland’s Minister of Finance announced a postponement of the National e-Invoice System (Krajowy System e-Faktur, KSeF) obligation introduction. A nationwide mandate set to take effect on July 1st, 2024, has been postponed to 2026. From the moment it is finally implemented, the obligation to issue structured invoices using KSeF will apply to taxpayers carrying out activities subject to the obligation to invoice in accordance with Polish VAT regulations.

As a rule, these will be domestic and foreign deliveries of goods and the provision of services between entrepreneurs (B2B) and for public authorities (B2G). It will also apply to foreign taxpayers performing activities subject to the invoicing requirement according to Polish VAT regulations, who have their registered office or permanent place of business in Poland. As a result of public consultations, invoices issued to natural persons not conducting business activity (B2C) were excluded from e-invoicing.

As of now, electronic invoice exchange is not yet mandatory for B2G or B2B transaction in Poland. However, public institutions have been obliged to receive e-invoices from their suppliers on demand since 2019.

With the progress of digitization in mind, The Ministry of Finance wants KSeF to implement a mandatory solution covering almost all transactions.

Mandatory e-invoicing in Poland will come into effect on:

In 2019, a special e-invoicing platform was made available for issuing invoices to government organizations: Electronic Invoicing Platform - PEF. In the area of B2B invoicing, the National e-Invoice System (KSeF) was introduced on an optional basis in 2022, enabling the issuance, receipt and storage of structured invoices. It is also used to mark invoices with an identification number, and to check the compliance of invoices with a specific template. Both systems, KSeF and PEF, currently operate independently.

However, the implementation of KSeF will affect the current system of handling electronic invoicing in public procurement using PEF. The legislator provides a solution ensuring interoperability of PEF and KSeF systems. Invoices issued in PEF, after positive validation, should receive a KSeF/UPO number and should be made available to the issuer of such an invoice in PEF.

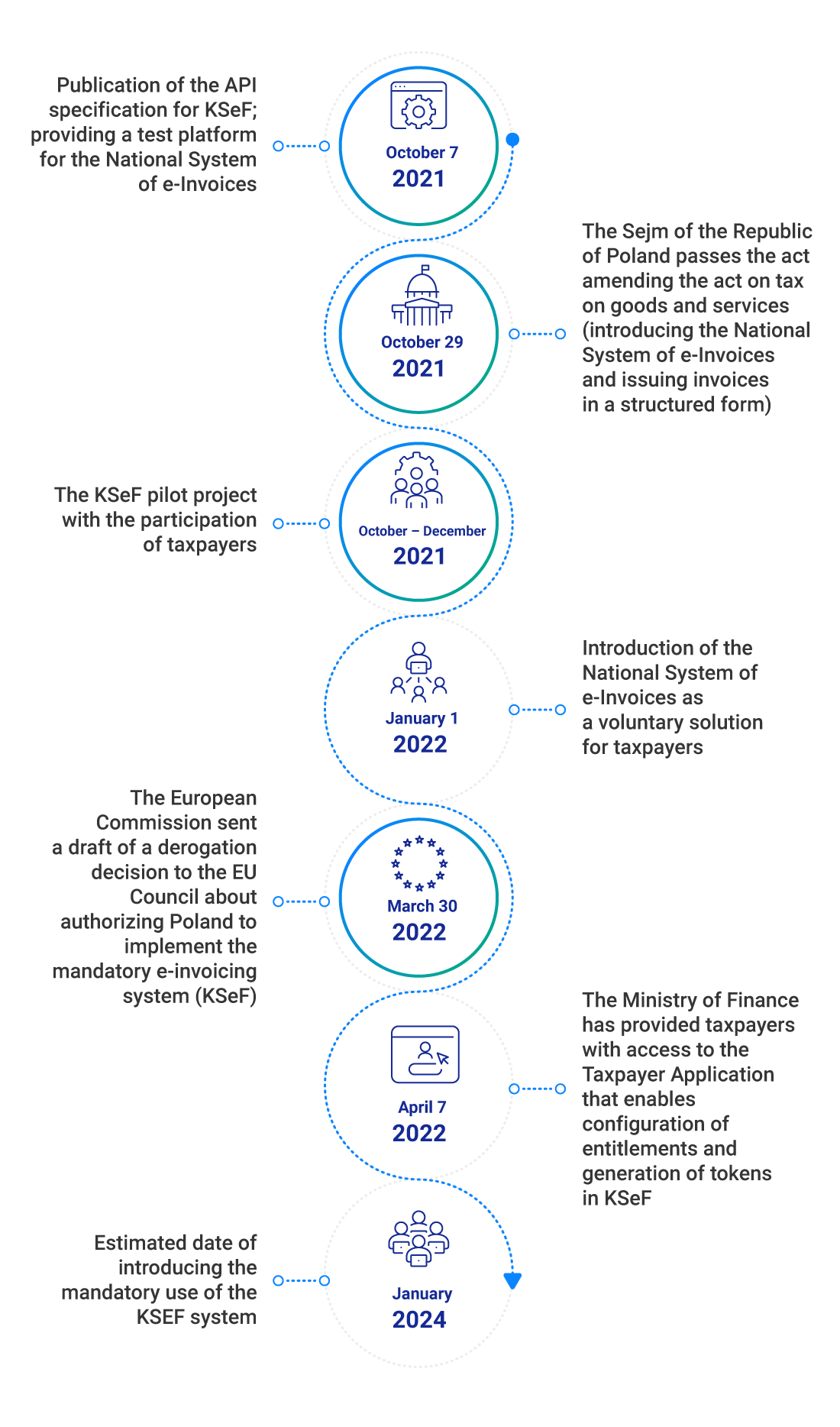

2021

2021Publication of the API specification for KSeF; providing a test platform for the National System of e-Invoices

The Sejm of the Republic of Poland passes the act amending the act on tax on goods and services (introducing the National System of e-Invoices and issuing invoices in a structured form)

The KSeF pilot project with the participation of taxpayers

2022

2022Introduction of the National System of e-Invoices as a voluntary solution for taxpayers

The European Commission sent a draft of a derogation decision to the EU Council about authorizing Poland to implement the mandatory e-invoicing system (KSeF)

The Ministry of Finance has provided taxpayers with access to the Taxpayer Application that enables configuration of entitlements and generation of tokens in KSeF

2024

2024Poland's Minister of Finance annunced a postponement of the National e-Invoice System (Krajowy System e-Faktur KSeF) obligation introduction.

Polish President Andrzej Duda signed an amendment to the previously applicable regulations specifying the date of entry into force of the obligation to use KSeF. Date for the obligation to use the National e-Invoice System has been postponed to February 1, 2026.

2026

2026February 1, 2026 - the effective date of KSeF in Poland.

Based on the act passed by the Sejm of the Republic of Poland, a structured invoice should be issued and received via the KSeF, using interface software. It has an electronic form and is created in accordance with the provided template. The e-invoice must be presented in XML format in accordance with the logical structure of e-Invoices (FA_VAT). It is, therefore the third type of invoice next to paper and electronic invoices that are in force in Poland. After e-invoices are delivered to KSeF, they will be provided with a time stamp and a unique identification number (KSeF ID), and the official receipt (UPO) will be returned to the invoice issuer.

Access to the National System of E-invoices may be obtained by a taxpayer, an authorized person, an authorized entity, or one of the entities referred to in Art. 106c of the Act, as long as they are authorized to issue (or make available) structured invoices. The legislator is to ensure the possibility of issuing a structured invoice via a dedicated platform for micro-enterprises (directly in the system via a web interface). Another option is to prepare invoices in the taxpayers' ERP systems accordingly to the published template. In the case of issuing invoices using an in-house financial and accounting system, the documents should be delivered to KSeF via a defined link, for example, via Comarch EDI to KSeF API.

As an operator of electronic document exchange (including e-invoices), Comarch monitors legislative changes in Polish law on an ongoing basis. We are very involved in the KSeF pilot project, and our specialists are present at meetings during which technical details of the system, structural invoice specification and API documentation are discussed.

The API of the National System of E-invoices is to enable integration with Comarch EDI (used by thousands of customers in Poland and abroad). This means that all users of our platform will be able to send and receive e-invoices to/from KSeF. Comarch EDI will also ensure full compliance with the latest regulations and transparency of the circulation of all invoices (and their statuses).

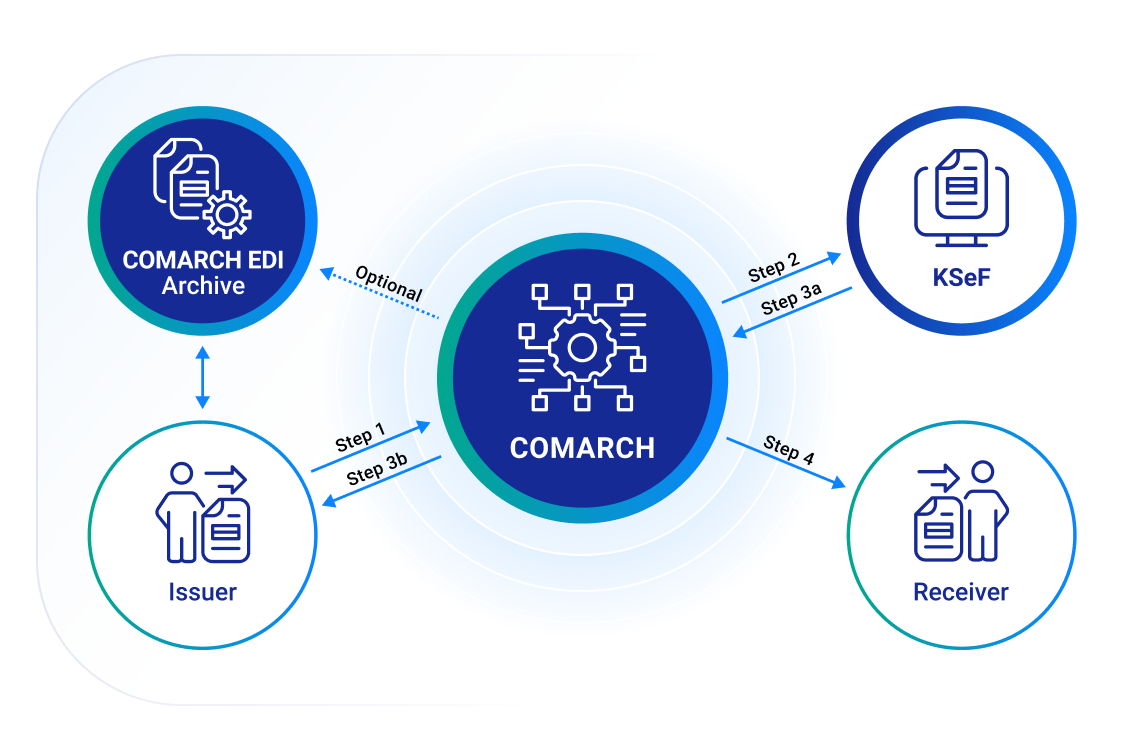

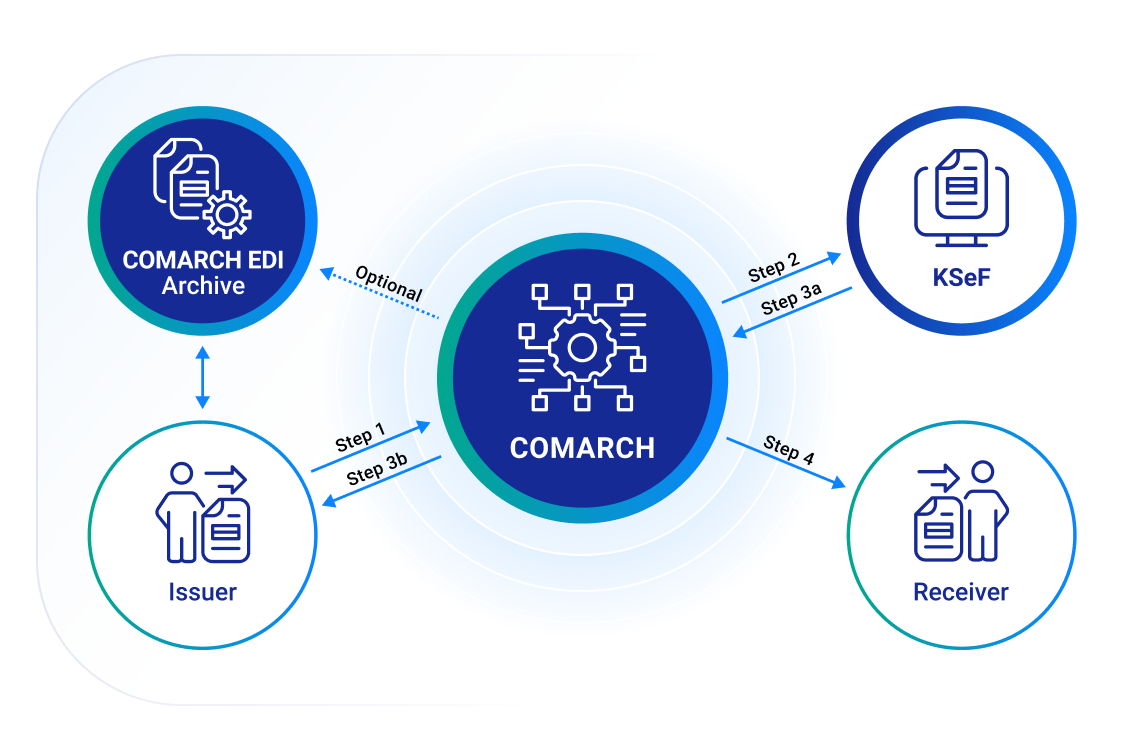

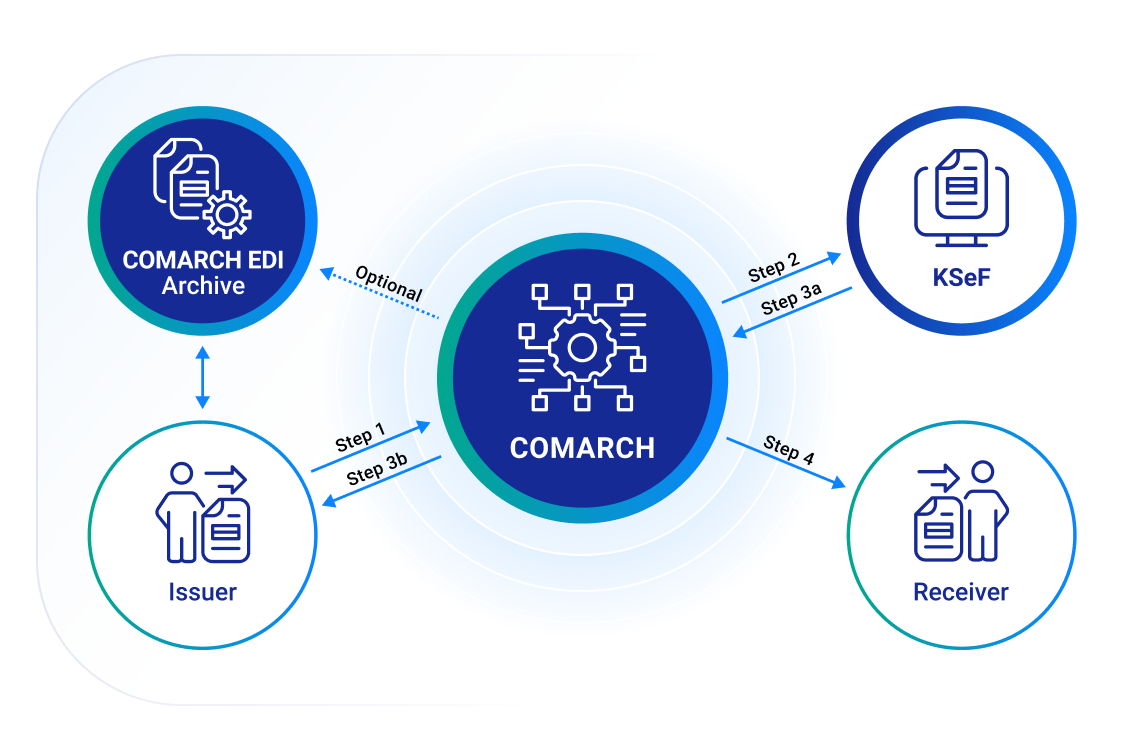

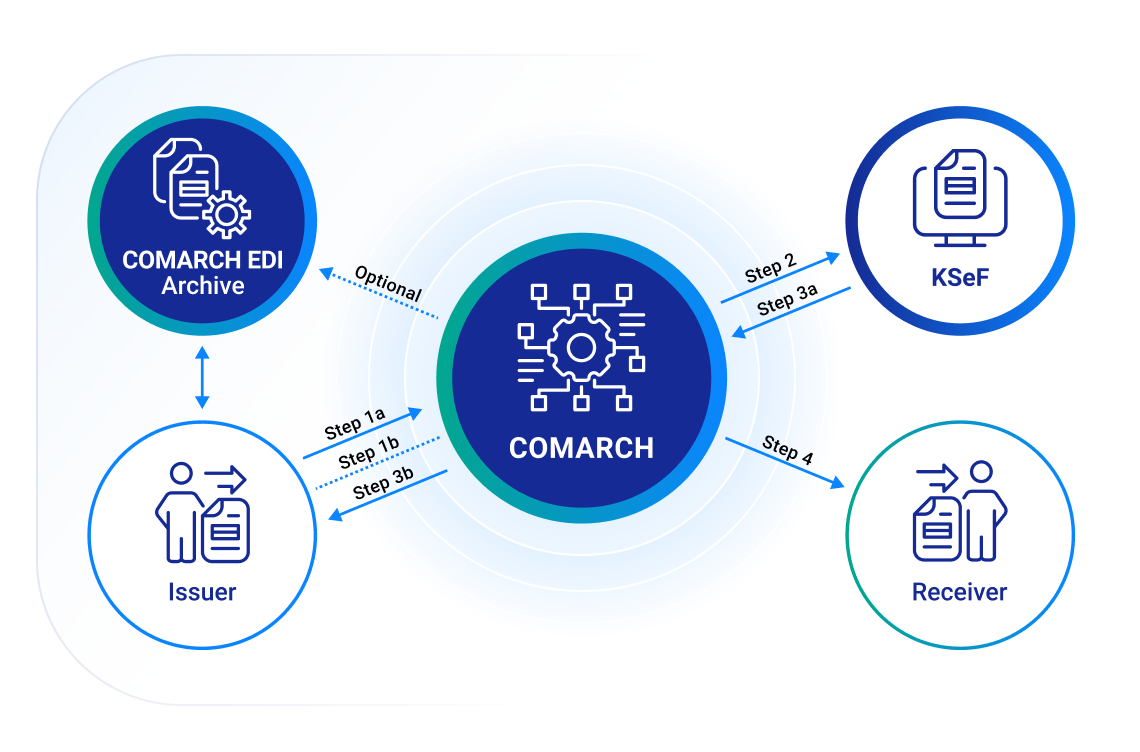

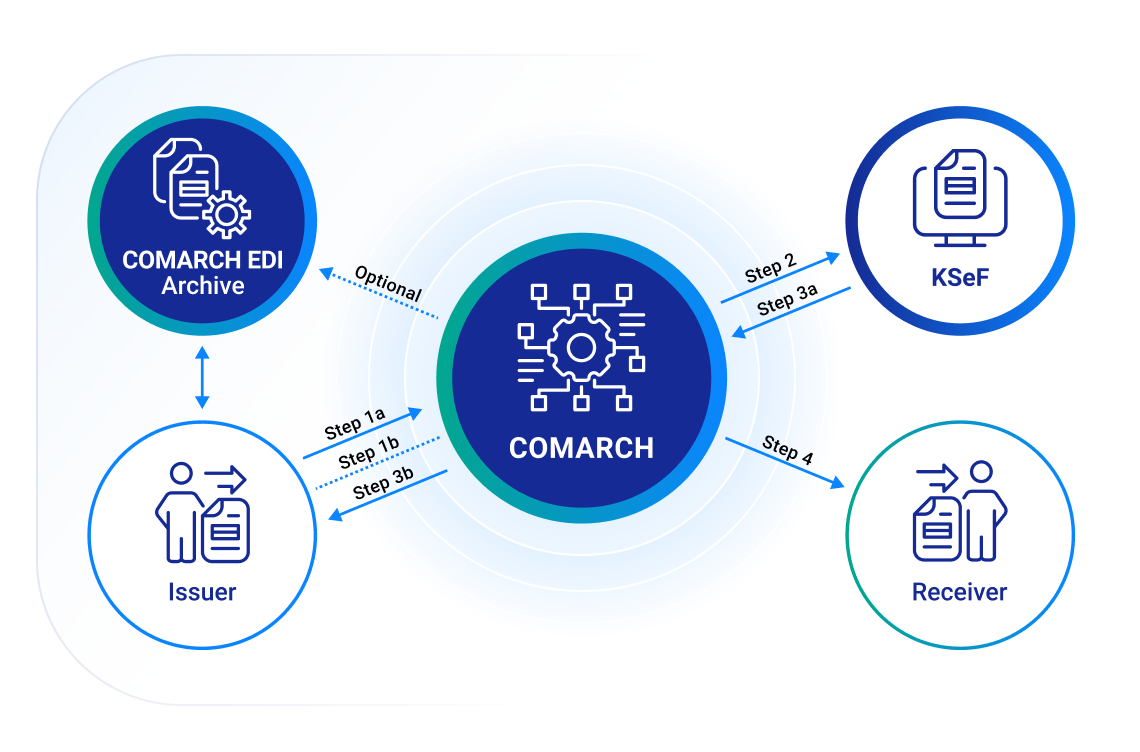

Comarch EDI clients have 2 integration and communication models to choose from for the interaction with the government KSeF system.

This process involves the exchange of e-invoices with basic technical validation, ensuring full compliance of invoices with the requirements of the KSeF scheme.

Step 1: Invoice submission to Comarch EDI

Step 2: Invoice authentication in the National e-Invoice System (KSeF).

The process includes:

Step 3: Downloading statuses and KSeF ID for a given invoice in Comarch EDI

Downloading KSeF feedback statuses and forwarding them to the invoice issuer.

Step 4: Receiving the invoice

Receipt of the invoice in the recipient’s internal system after prior token authentication. The invoice is transferred to the recipient after conversion from the KSeF XML format to the format required by the recipient’s system.

Storing invoices in Comarch EDI Archive is optional. There, invoices are stored in source and KSeF XML formats, along with invoice status and an official acknowledgment of receipt (UPO). Additionally, the history of KSeF unavailability and re-transmission to the National e-Invoice System is provided.

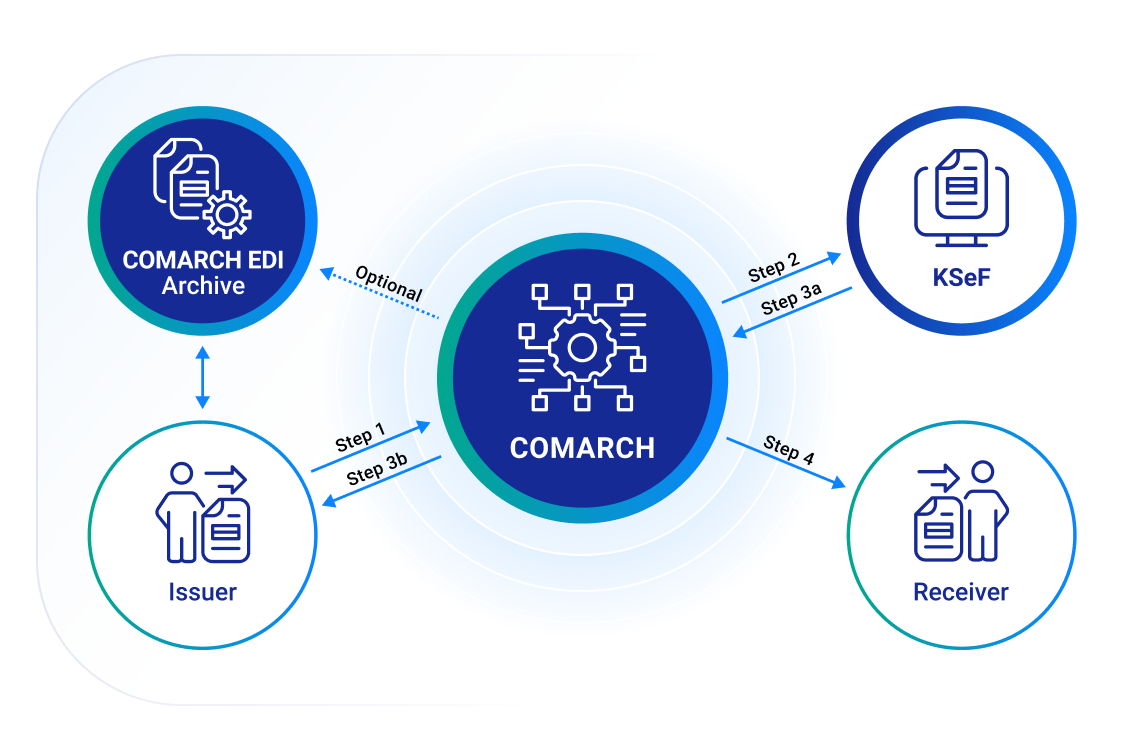

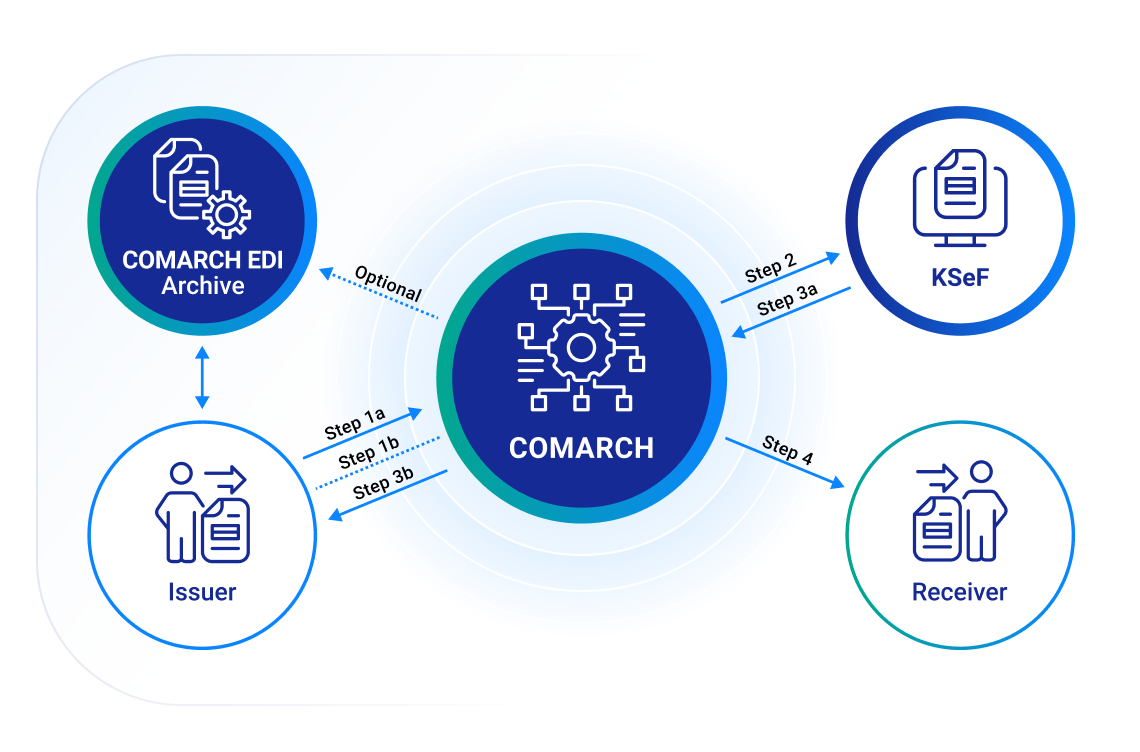

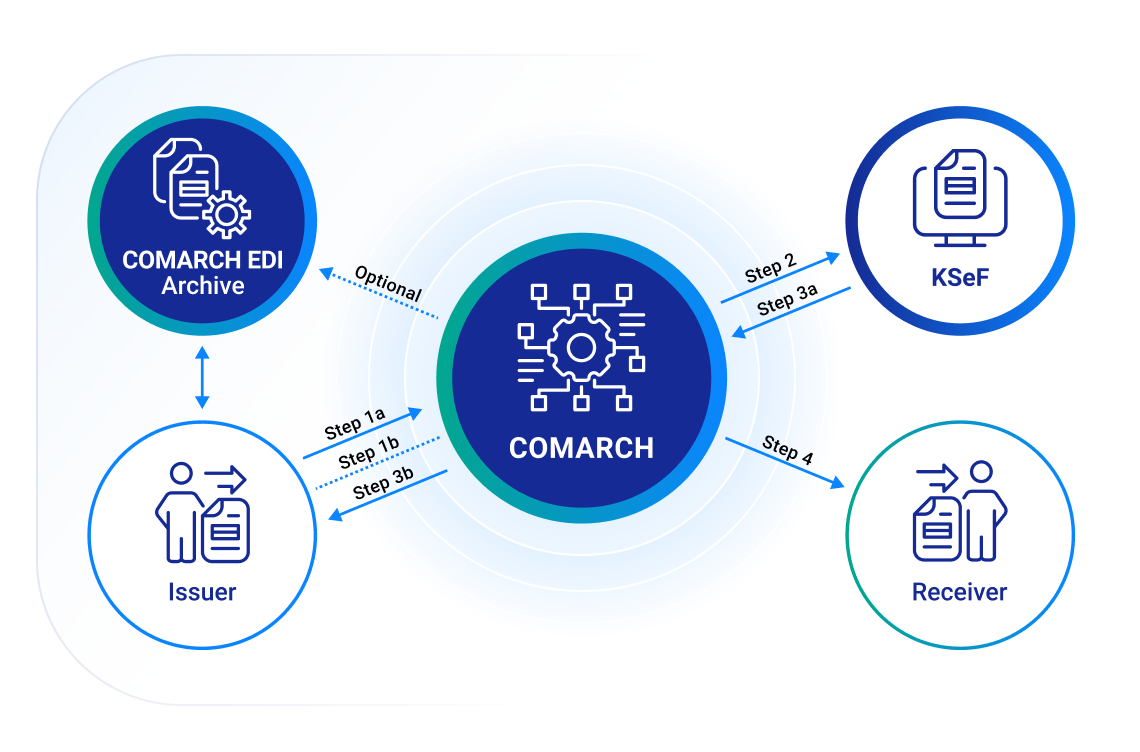

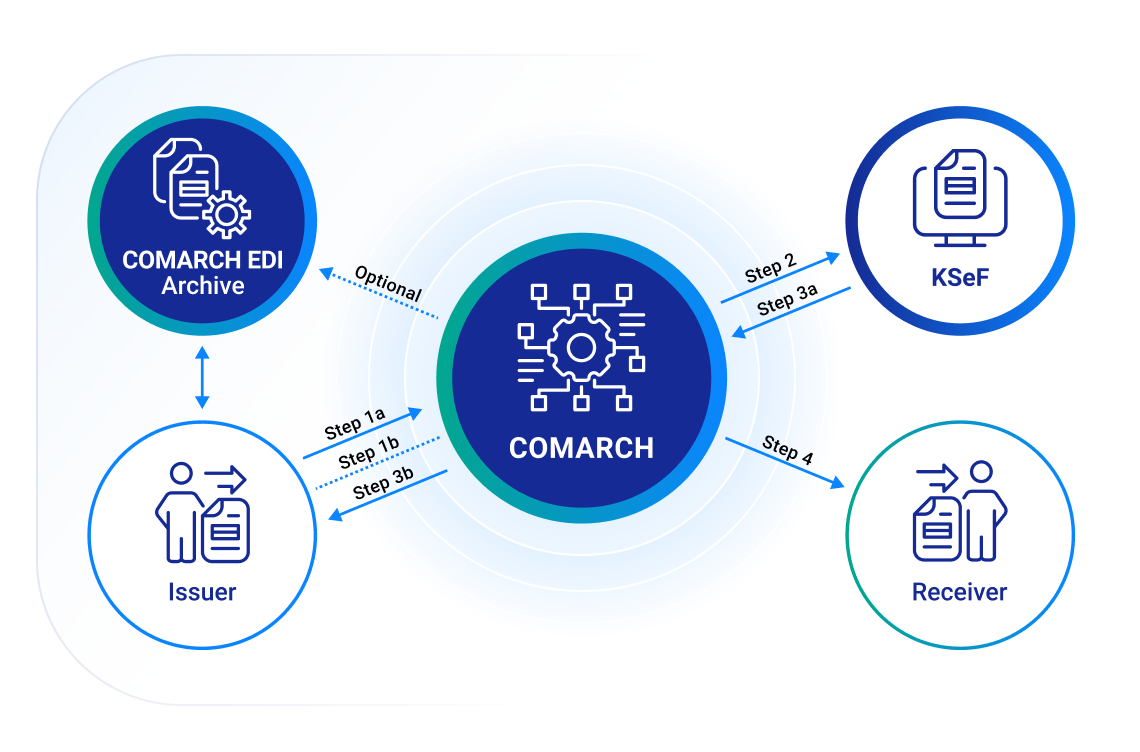

This model involves considering additional, specific customer requirements regarding invoice processing, for example, including business validations.

Step 1: Invoice submission to Comarch EDI

Step 2: Authentication of the invoice in the National e-Invoice System (KSeF)

This process includes:

Step 3: Downloading statuses and KSeF ID for a given invoice in Comarch EDI

Downloading KSeF feedback statuses and forwarding them to the invoice issuer.

Step 4: Receiving the invoice

Receipt of the invoice in the recipient’s internal system after prior token authentication. The invoice is transferred to the recipient after conversion from the KSeF XML format to he format required by the recipient’s system.

Storing invoices in the Comarch EDI Archive is optional. There, invoices are stored in source and KSeF XML formats, along with invoice status and an official acknowledgment of receipt (UPO). Additionally, the history of KSeF unavailability and re-transmission to the National e-Invoice System is provided.

All invoices must be structured and compliant with the KSeF

Comarch will take care of adjusting the format in which you send your invoices to the requirements imposed by KSeF. You don't have to waste time to manually adjust each invoice.

My customers and suppliers have different requirements as to the information included on the e-invoices. Aside from verifying whether the documents are compliant with KSeF specification, I also need business validation to meet also my partners’ expectations.

With Comarch, you can maintain the validation of multi-document processes. Thanks to this, you will be sure that all the required information is included in the invoice, even if the KSeF does not require it.

I want to have access to all of my documents any time I want to export an invoice that was previously registered in KSeF - together with all its history of statuses.

Comarch allows you to store KSeF XML invoices together with the history of KSeF statuses, invoice identification number or UPO (confirmation).

I want the system to be operated by true specialists with a lot of experience in similar projects.

Comarch has many years of experience in carrying out electronic documents exchange projects, which often include the management of processes related to sending and receiving documents to/from governmental institutions in many countries.

On January 19, 2024, the Minister of Finance announced that the obligation of e-invoicing will not be implemented according to the earlier plans, starting from July 1, 2024.

Based on the adopted changes, the initial date for the obligation to use the National e-Invoice System has been postponed to February 1, 2026. At the same time, the Ministry of Finance announced that proposals for the phased introduction of mandatory KSeF will appear in the next draft, which will be disclosed by the end of 2024.

To ensure integrity and authenticity of e-invoices, any method is accepted, such as Qualified Electronic Signature. Data sealed with a qualified electronic seal enjoy the presumption of integrity and authenticity.

Storage period 5 + 1 years.

KSeF (Polish abbreviation for Krajowy System e-Faktur) is a national system introduced with the Polish law on the amendment of the Value Added Tax Act and further laws of October 29, 2021 [Ustawa z dnia 29 października 2021 r. o zmianie ustawy o podatku od towarów i usług oraz niektórych innych ustaw]. The system’s aim is to enable issuing and receiving structured invoices.

Yes. The system was introduced as a facultative solution on January 1, 2022.

The original date for mandating the use of the National e-Invoice System has been pushed back to February 1, 2026. Concurrently, the Ministry of Finance announced that proposals for a phased implementation of mandatory KSeF will be included in the upcoming draft, set to be revealed by the end of 2024.

Krajowy System e-Faktur is addressed to all enterprises in Poland, i.e. companies subject to turnover tax, companies exempt from turnover tax, and companies that are subject to the special EU regulation “One-stop shop” (OSS) in Poland and have a Polish tax identification number (NIP).

The use of KSeF offers numerous advantages to taxpayers. In particular, the settlement of structured correction invoices will be facilitated, the obligation to provide invoices in JPK format (Jednolity Plik Kontrolny [Polish for: standard audit file]) will be omitted, the turnover tax will be refunded sooner, and invoices will be archived in KSeF over a period of ten years.

Comarch EDI KSeF is a service dedicated to such customers looking for a solution integrated with KSeF.

For more information about what is KSeF, when it will become mandatory and who has to issue structured invoices, check our Questions and Answers.

Click on the button to get in touch with one of our experts