From Transactions to Long-Lasting Trust

Drive deeper engagement with data-driven Comarch Loyalty Marketing Platform for Banking. Don't just bank on loyalty, invest in it

From Transactions to Long-Lasting Trust

Drive deeper engagement with data-driven Comarch Loyalty Marketing Platform for Banking. Don't just bank on loyalty, invest in it

As digital banking becomes the norm and customer expectations skyrocket, it's time to supercharge your loyalty program. Stop selling financial products and start building your customers' dreams! With Comarch Loyalty Marketing Platform, leverage AI for personalized offers that resonate with your customers, driving engagement and loyalty. Our secure, cloud-based platform empowers you to offer a wider range of rewards beyond banking products, ensuring your bank remains their trusted financial partner. Rest assured, your customers' data is protected with state-of-the-art security measures and PCI compliance.

Drive primary card usage with tailored loyalty programs and a wide range of rewards.

Leverage pre-built configurations and multi-country support to get your program up and running quickly.

Offer a diverse range of non-banking rewards that resonate with your customers worldwide.

of customers view their relationship with their bank as more than transactional

of millennials are likely to switch financial advisory firms over the next year

of customers would remain with the brand that makes them feel understood, respected, confident, valued, and appreciated

of banks are investing in digital to increase revenue

Learn more about the main modules of the Comarch Loyalty Marketing Platform

Build stronger relationships with various types of partners.

Quickly expand the rewards and benefits of your program’s portfolio.

Drive engagement and attract younger customers with challenges, badges, and progress bars.

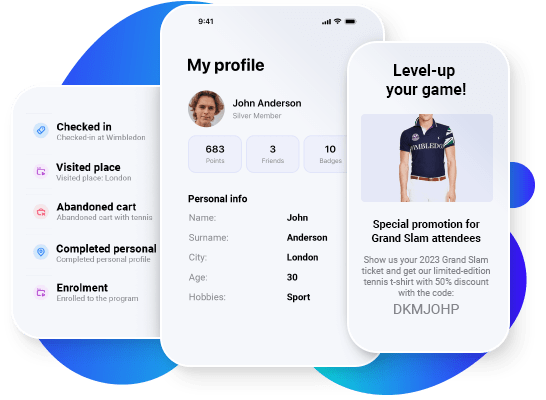

Comarch Loyalty Marketing takes banking loyalty to the next level. We leverage cutting-edge AI to personalize rewards and interactions for each customer, building stronger relationships and boosting engagement.

Motivate customers to deepen their relationship with your bank by implementing a tiered loyalty program with Comarch Loyalty Marketing Platform.

Upcoming RFP? More info about product and services? Talk integrations? Need a price estimation?

“2023 Market Guide for CSP Revenue Management and Monetization Solutions”

“2023 Market Guide for CSP Revenue Management and Monetization Solutions”

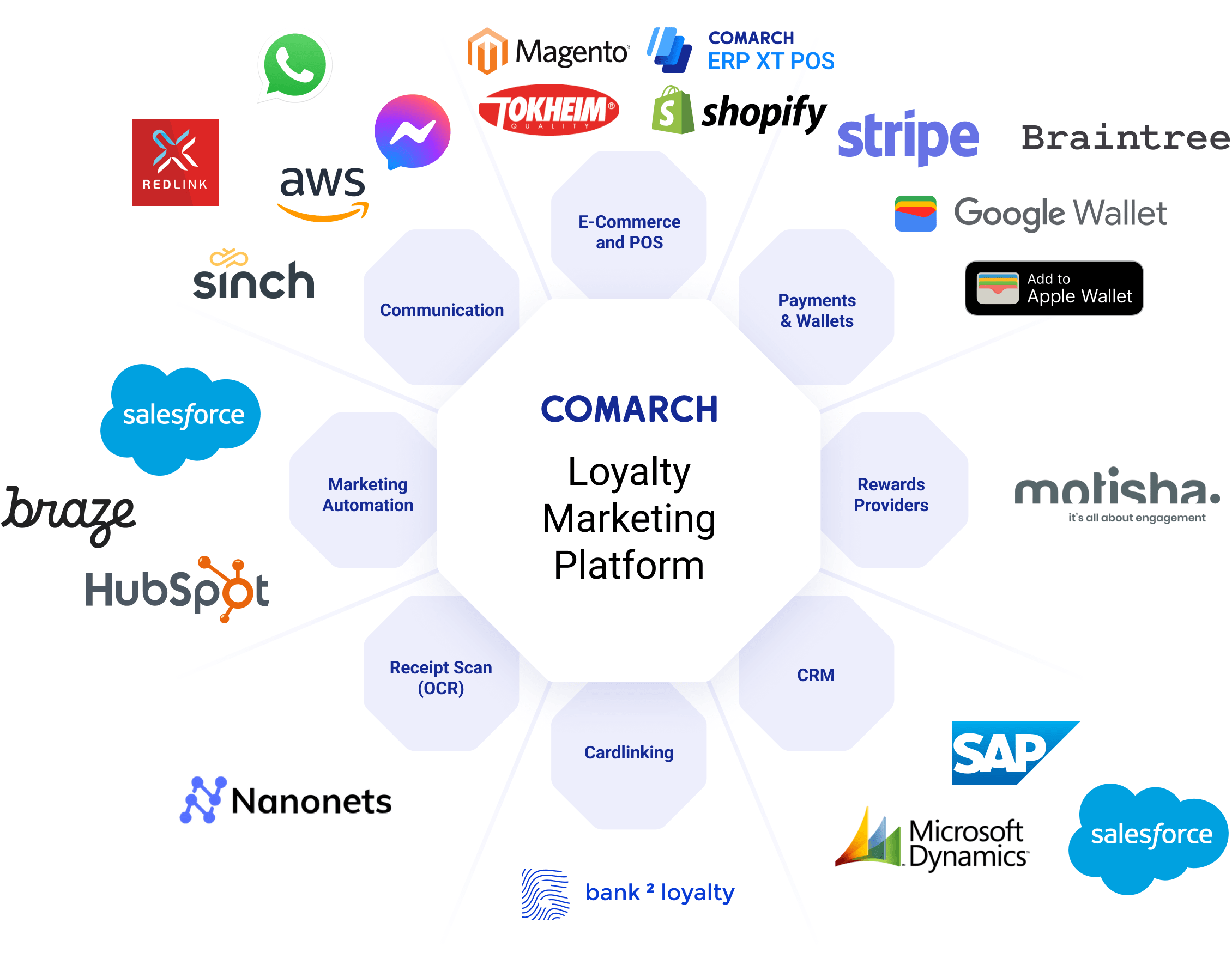

Thanks to our banking expertise, you can combine our loyalty management system with your existing tech stack and launch your banking program bump-free. We understand that banking needs can be unique – if needed, you can always get one of our trusted partners or us to develop custom integrations over API to match your specific requirements.

Connect your banking loyalty program across all channels

CLM integrates effortlessly with your existing banking infrastructure, including core banking systems, online banking platforms, and mobile banking apps.

of industry experience

offices in over 33 countries

processed loyalty transactions

members of loyalty programs

We have built a truly trustful relationship with Comarch and I am pleased to see all local BP branches satisfied with this relationship. The work we have done together has fully satisfied our expectations and by this I mean on a global and local level. Comarch’s specialists have huge experience and are always full of innovative ideas on how to make the program even better and more attractive.

We have built a truly trustful relationship with Comarch and I am pleased to see all local BP branches satisfied with this relationship. The work we have done together has fully satisfied our expectations and by this I mean on a global and local level. Comarch’s specialists have huge experience and are always full of innovative ideas on how to make the program even better and more attractive.

The goal was to create an inclusive ecosystem that would help the client save and benefit in every aspect of day to day life. With assistance from Comarch the Enoc loyalty team was able to create a convenient loyalty programme of collaborating partners all across the middle east rewarding every customer for their refueling or shopping experience. The Yes app is accessible and easy to navigate towards exciting and instant rewards.

The goal was to create an inclusive ecosystem that would help the client save and benefit in every aspect of day to day life. With assistance from Comarch the Enoc loyalty team was able to create a convenient loyalty programme of collaborating partners all across the middle east rewarding every customer for their refueling or shopping experience. The Yes app is accessible and easy to navigate towards exciting and instant rewards.

With Comarch Loyalty Management we are using a tool that, based on one IT platform, allows each country to adapt the program SMILE & DRIVE to its market specific needs. Using the same scope of functionalities, program rules and parameters can be adapted in such a way that in each country specific points’ rules and promotions can be put in place.

With Comarch Loyalty Management we are using a tool that, based on one IT platform, allows each country to adapt the program SMILE & DRIVE to its market specific needs. Using the same scope of functionalities, program rules and parameters can be adapted in such a way that in each country specific points’ rules and promotions can be put in place.FEATURED CASE STUDY

Comarch & Livelo Brasil: Building a Loyalty Powerhouse

Facing the challenge of merging programs from two-thirds of Brazil's biggest banks, Livelo Brasil partnered with Comarch to create a dynamic, multi-partner loyalty program. Comarch's expertise facilitated a seamless data migration (16+ million accounts!) and system integration, propelling Livelo to become one of Brazil's leading loyalty programs in just nine months.

Comarch Loyalty Marketing Platform has all it takes to help you protect sensitive banking information.

We utilize industry-leading security protocols, hold relevant certifications, and conduct regular penetration testing to ensure the safety of your customer information. Additionally, features like multi-factor authentication offer an extra layer of protection.

Our AI/ML-powered system can identify anomalies in customer behavior specific to banking activities, such as suspicious spending patterns or attempted account takeovers. Take swift action and prevent fraudulent activities before they impact your business.

Set up a free 30-minute session with one of our industry experts

Describe your case and learn the basics about our product

|

| Wojciech Kempny Loyalty Consulting Director |

Tell Us Your Case 💬

Upcoming RFP? More info about product and services? Talk integrations? Need a price estimation?

FEATURED E-BOOK

Building loyalty in finance is more challenging than ever. How can banks distinguish their services, secure customer loyalty, and strengthen their brands? Get our new ebook to discover how to meet your customers' needs and stay ahead of competitors!

Deposits of Inspiration

Several factors drive customer loyalty in banking: convenience, competitive rates, personalized rewards, and exceptional customer service. Building trust and exceeding customer expectations are key.

Focus on offering seamless digital experiences, tailoring rewards to customer preferences, and providing valuable financial tools and resources. Building strong relationships with personalized communication is also crucial.

Track key metrics like customer retention rate, net promoter score (NPS), customer acquisition costs, and engagement with your loyalty program. Analyzing these metrics helps assess program effectiveness and identify areas for improvement.

AI can personalize rewards based on customer behavior, predict customer needs, and identify potential churn risks. Additionally, AI automates tasks, improves fraud detection, and makes setting up your loyalty program much easier.