The Future of AP Automation in a New World

Every company around the globe has felt the effect of the recent crisis in some way or another and companies using outdated AP software have faced the brunt of the crisis. In the past, many companies did not perceive AP Automation as a priority -- but this is changing rapidly. The shift to work-from-home and increased digitization has created a greater need to expedite payments and manage cash flow more effectively. It is vital to any organization’s financial health to keep money flowing, especially as so many businesses are facing financial uncertainty.

Unfortunately for firms who are still using manual accounts payable processes, many are struggling with limited visibility and control over their invoices and unrecorded liabilities and cash flow. These problems create a bottleneck in payments and unpredictable cash flow. By automating portions of the AP process, businesses are able to get a clear picture of their cash flow without manually sorting data and creating reports -- all while reducing invoice processing costs.

In recent years, the key challenge for Accounts Payable professionals has been to step away from the manual, paper-based processes and find a way to automate the invoice workflow. As the world becomes increasingly data-driven, organizations must digitize their business processes and automate manual tasks, or they risk falling behind their competition. Pre-crisis, many organizations were still managing to stay afloat while continuing to perform day-to-day operations manually. Once the crisis hit, however, this all began to change.

In recent years, the key challenge for Accounts Payable professionals has been to step away from the manual, paper-based processes and find a way to automate the invoice workflow. As the world becomes increasingly data-driven, organizations must digitize their business processes and automate manual tasks, or they risk falling behind their competition. Pre-crisis, many organizations were still managing to stay afloat while continuing to perform day-to-day operations manually. Once the crisis hit, however, this all began to change.

The future of AP: What should you expect?

1. Ease of use for all users – remote or not

Now that so many people around the world are working remotely, mobile capabilities have become increasingly important. Organizations must be able to keep their invoice workflows and approvals moving forward regardless of where their employees and business partners are located. This can be difficult for companies that still use legacy software that is not user-friendly and requires significant training for new users.

Ensuring an easy and intuitive user interface (UI) and user experience (UX) is crucial to maintaining good relationships with business partners. Users are looking for the same quality of UI & UX that they see with the consumer apps they use on a daily basis. Increased automation will further simplify the user experience. Additionally, users are looking for solutions that are easy to implement and that require minimal training.

2. Digitalization will become crucial

Manual invoice handling is time-consuming, costly and error-prone, and it can often lead to missing invoices and late payments, not to mention the penalties that come along with those late payments. In the post-pandemic world, it is more important than ever for organizations to reduce inefficiencies and make the best use of their workforce.

Companies will begin to re-assess their processes to remove unnecessary steps and streamline operations, as this is pivotal to any organization’s financial management. With AP automation, data will flow automatically from clients and systems directly into AP automation software. Manual data entry, and the errors it can often introduce, will be a thing of the past.

As one of the last departments to be digitized, Accounts Payable is ready to reap the efficiency, cost savings, and strategic benefits that others have achieved through automation. Instead of spending time on tedious tasks, AP professionals will be able to shift their focus to more strategic tasks, which will give organizations access to more insights and help organize documents and important materials.

3. AP Automation will become powered by AI and machine learning

Organizations use AI and ML in many different ways, including for detecting errors and discrepancies. Based on historical data and in-depth traffic analysis, AI-enabled anomaly detection can automatically identify possible deviations or errors in invoice traffic as well as any other problems within the document exchange and immediately alert necessary users to rectify the situation.

Advanced AP automation solutions use optical character recognition (OCR) paired with AI to intelligently fill in missing information into the invoice fields.By using information from similar vendors and invoice formats, the OCR technology builds an invoice pattern for organizations and invoice types. This ensures that invoicing becomes more accurate over time and requires less manual intervention.

4. Additional security to reduce fraud

AP automation offers a solution to fraud, which can be very costly to businesses. Data collection and analysis tools can help organizations easily identify anomalies and trace them back to the source. The system issues red flags when it suspects fraudulent behaviors and AP Automation professionals are encouraged to dig deeper into the data. Some examples of red flags the system may identify are incomplete invoices, suspicious logins, last-minute changes in banking information, and changes in pricing among particular vendors.

How deploying the latest tech helps companies get ahead

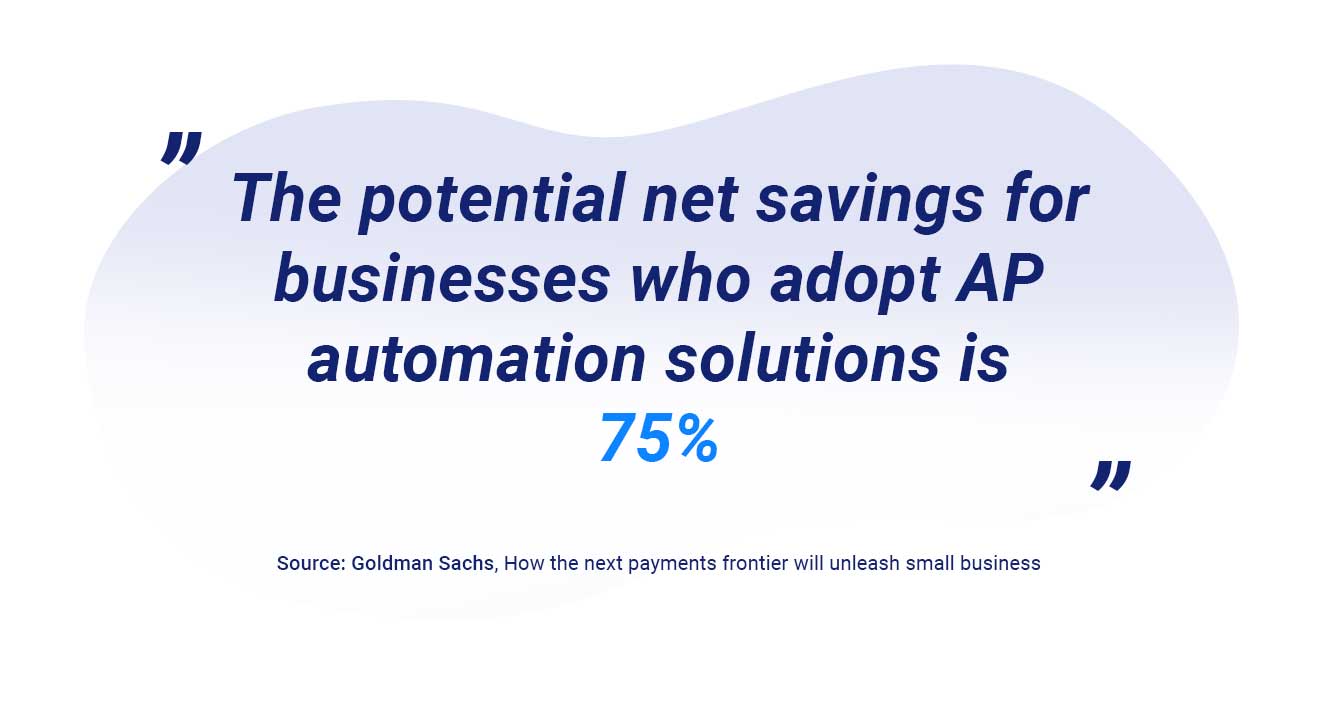

When businesses make the shift to AP automation, they don’t just cut AP costs and improve departmental efficiencies; they have the potential to turn their AP team into a strategic and data-driven accounts payable powerhouse.

AP Automation has been shown to accelerate approval cycles, increase employee productivity, reduce late-payment penalties, and lower overall invoice processing costs.