Comarch Loan OriginationAchieve top performance for all loan products and customer segments

Comarch Loan OriginationAchieve top performance for all loan products and customer segments

Comarch Loan Origination software provides solutions for all segments: retail, SME, and corporate.

Our solution can be used by:

Banks and other financial institutions

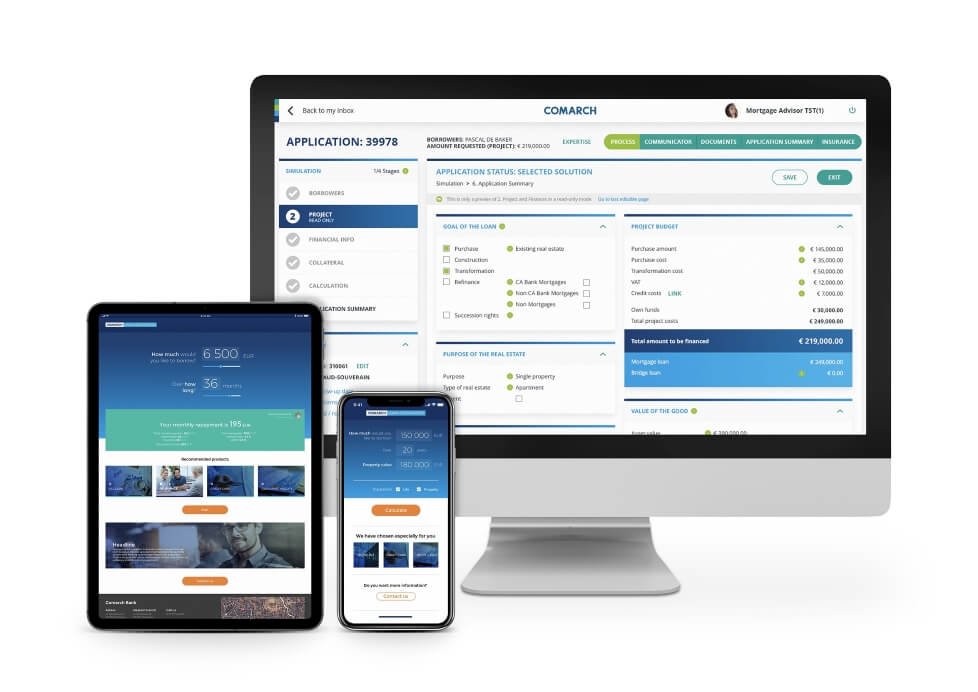

The platform incorporates a full portfolio of credit products – starting from quick loans for retail customers, through mortgage origination processes, to complex business loans for SMEs or corporations. Comarch Loan Origination software also supports multi-product and multi-entity agreements plus different cross- and up-sell strategies.

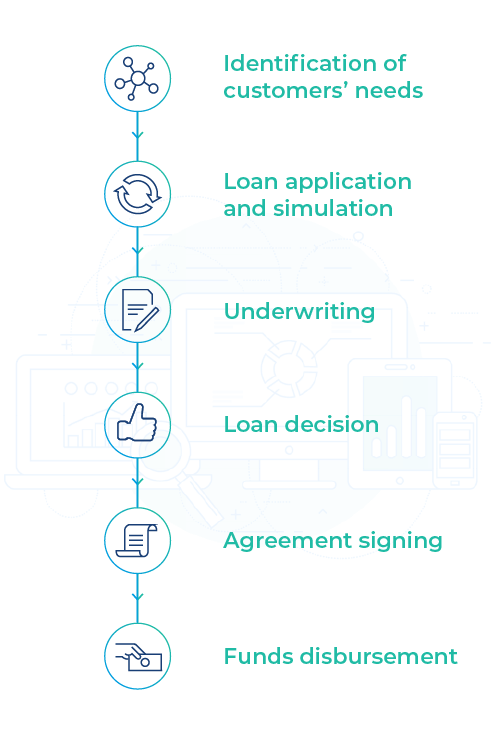

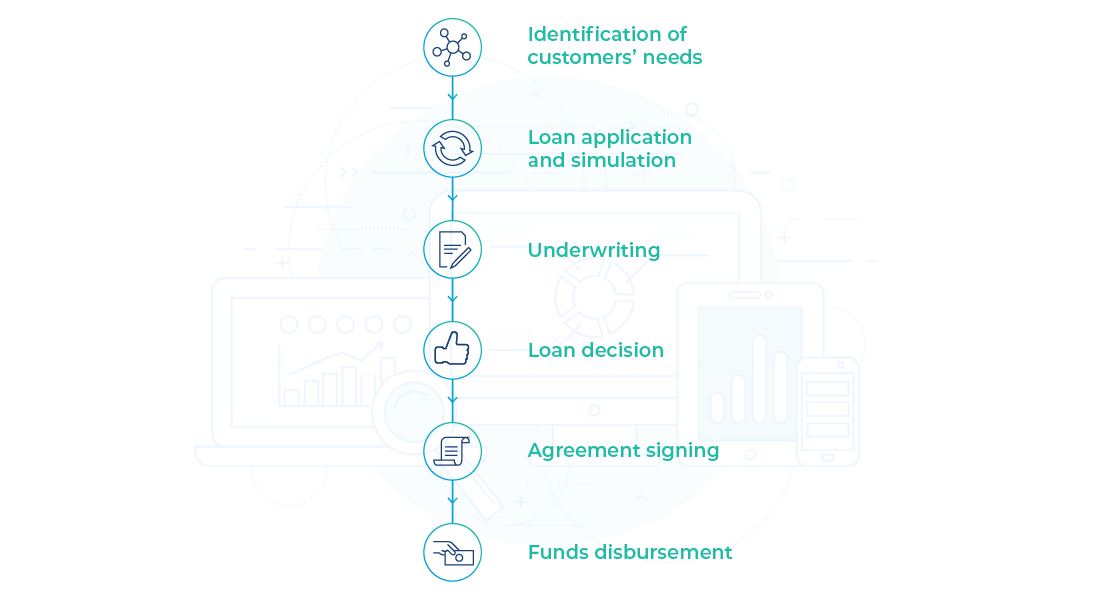

Comarch Loan Origination system is a comprehensive tool that will run all stages of the lending process starting from data collection all the way to fund disbursement – automating all the steps in between. It is designed to fit the market need for digital and automated lending experience.

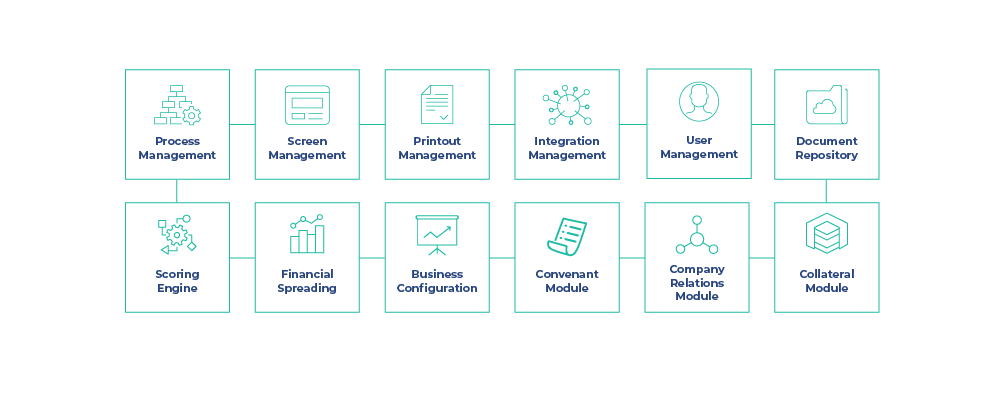

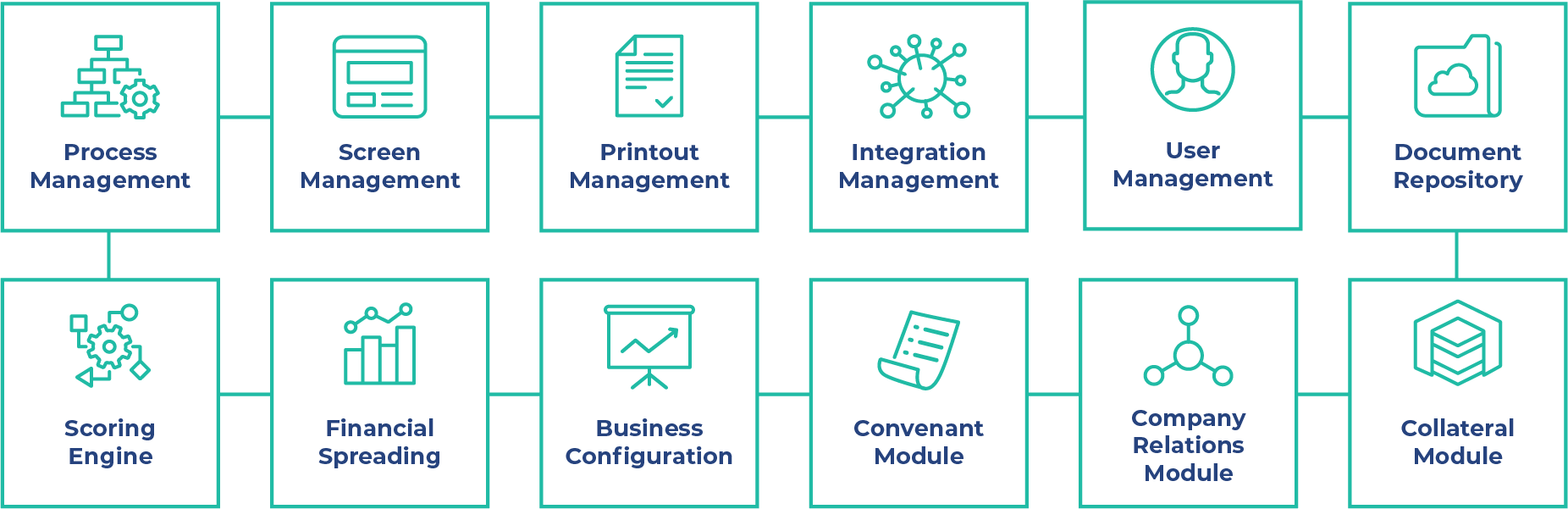

Configure new document templates or easily adjust the existing ones. Quickly add new legal clauses or other paragraphs; you can make their visibility dependent on specific loan conditions. Completed printouts are generated in MS Word or PDF format. Document checklists for the customer are generated automatically.

Attach digitalized documents to dedicated placeholders on the checklist and link those documents to a specific customer or loan applications. All attached documents are archived in the repository and can be searched and viewed by authorized users.

Design and implement strategies for the assessment of loan applications and credit risk related to a credit decision, and, in a wider scope, to the total debtor base. The use of the scoring module results in lower credit risk and improves the quality of the entire debt portfolio. Calculations can be based on quantitative and qualitative data coming from loan origination system and / or other systems.

Collect and analyze financial data using a predefined set of financial statement templates. The data can be captured from other systems and xls files or filled manually. Calculated financial ratios ensure better knowledge on your customer’s financial standing and result in more efficient credit risk management.

Define and register collaterals in credit processes and synchronize them with master collaterals database. This includes debt securing assets, it’s legal form, and valuation. Collateral once registered in the system can be used many times within other processes for the same customer.

Define customer’s organizational structure, economic, personal and ownership connections. Keep the information in one place, nicely presented in graphical form. Make it easier to identify and keep track of the ultimate beneficiary owner.

Simplify covenant management with proper covenants added automatically to loan agreements based on loan type, credit amount, or risk rate. Covenants are stored in the system and centrally managed. If needed, you can adjust covenants within a predefined range – the system will guide you on which adjustments you can make.

Intuitive graphic editor that allows you to configure lending processes with no need for expert IT knowledge. A short training will be enough to start using the tool. You can assign process tasks to users/roles, define timeouts for specific tasks, or validate the correctness of the process.

Manage user input forms: define questions and answers, assign default answers or add descriptions to question (tips). You can also configure checklist of documents required from customers.

Easily integrate the Comarch Loan Origination system with other existing internal or external systems and databases. You can configure webservices using graphical, intuitive editor which makes it possible for non-technical users to carry out tasks that otherwise would need to be performed by programmers.

Define parameters that are frequently changed, such as origination fee, and allow authorized business users to make modifications. Validations and warning texts can also be easily customized, with multilanguage configuration available.

Manage user access rights including:

Tell us about your business needs. We will find the perfect solution.