Watch the video interview and see how TMBThanachart (ttb) became one of Thailand's most innovative banks

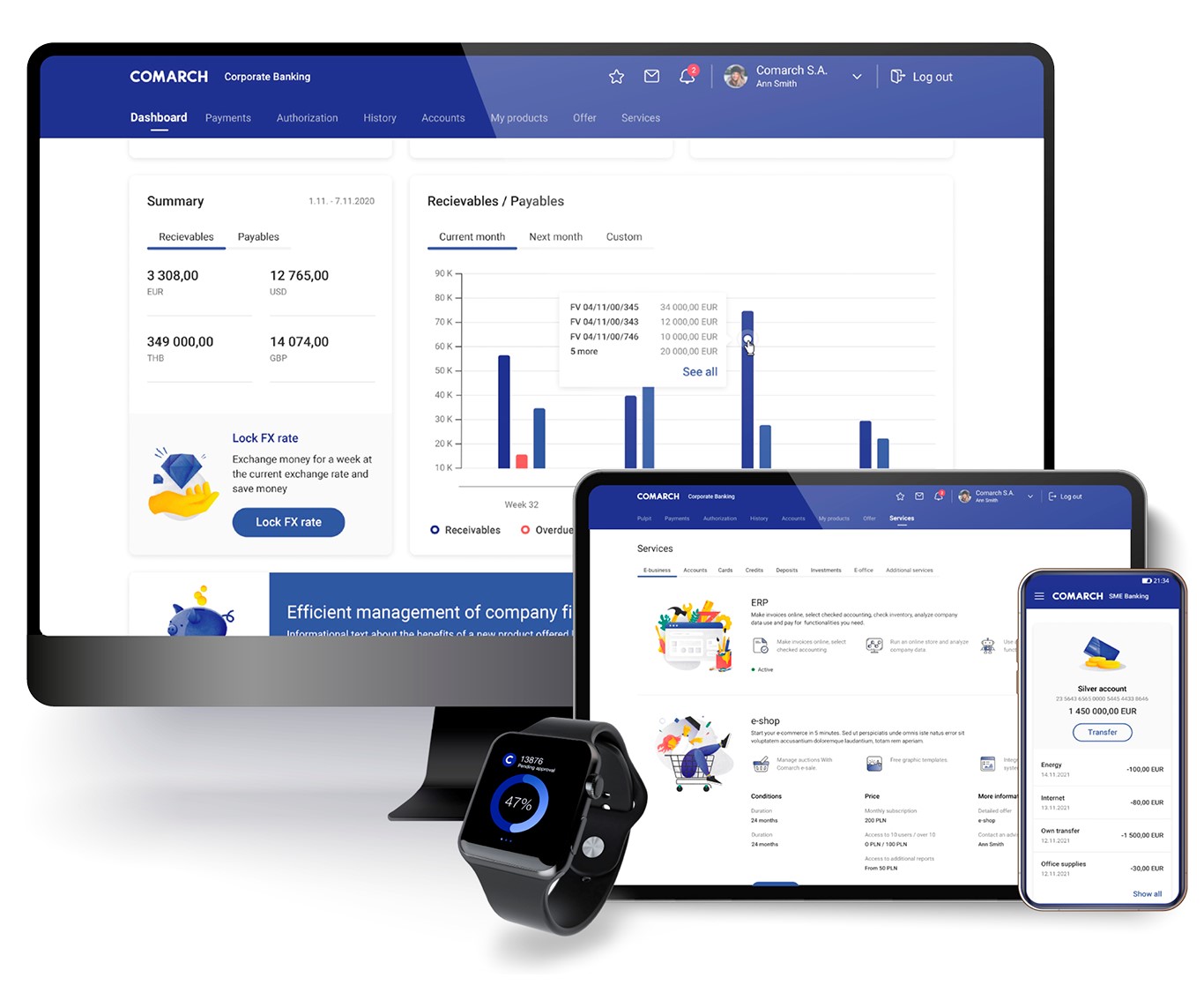

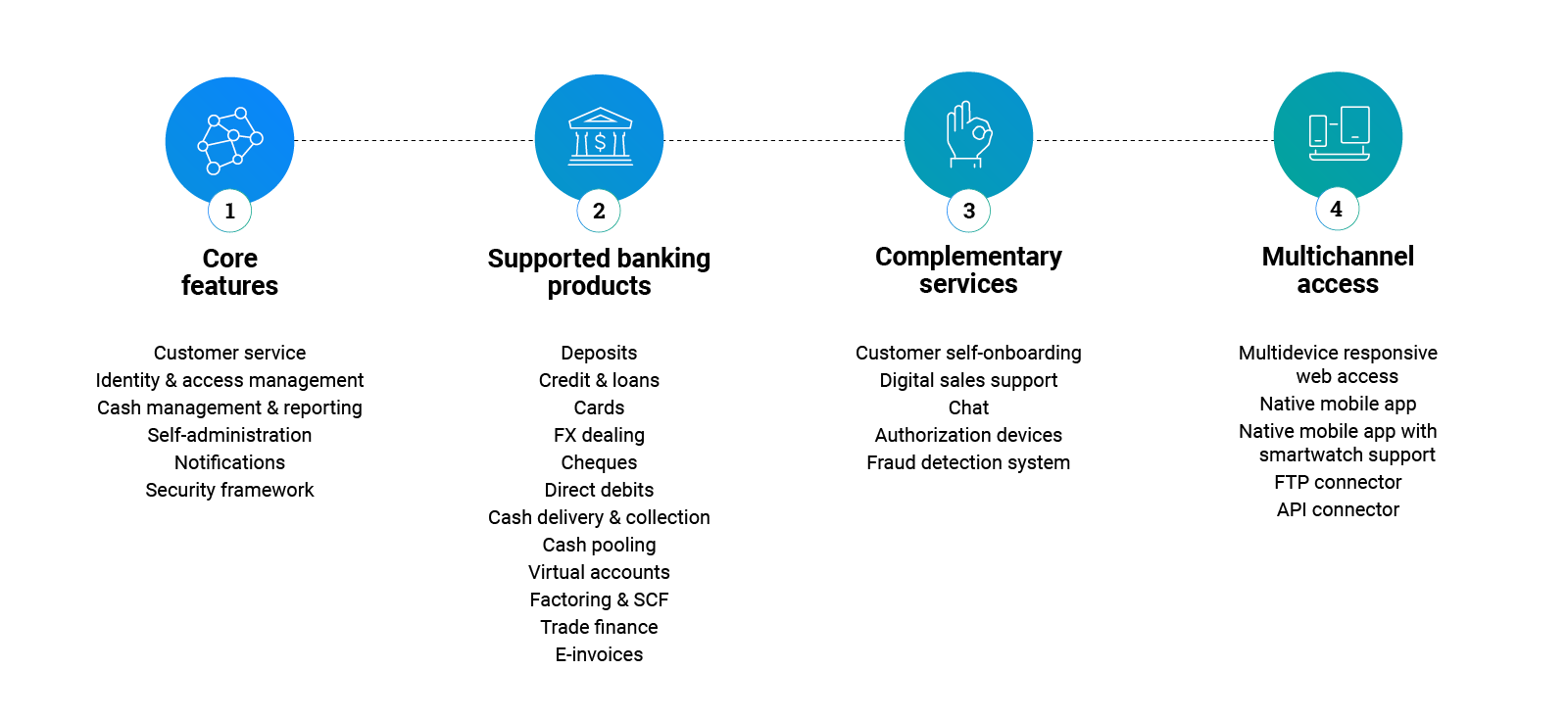

Comarch Corporate BankingStreamline transaction management and cut operating costs

Comarch Corporate BankingStreamline transaction management and cut operating costs Comarch’s Award-Winning Solution Transforms Banking in ThailandComarch and TTB Win Best Digital Transformation Implementation in Thailand

Comarch’s Award-Winning Solution Transforms Banking in ThailandComarch and TTB Win Best Digital Transformation Implementation in Thailand