Company: DNB Bank Polska S.A.

Industry: Banking

Implemented solution:

Solution supplier: Comarch

Project duration: 2004 – onward

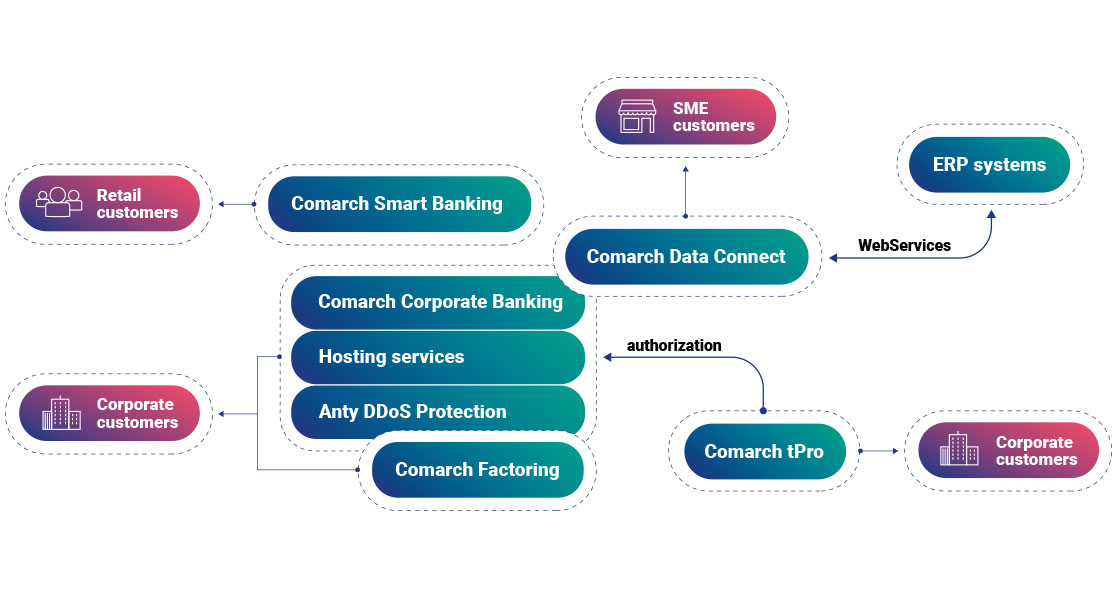

DNB Bank Polska S.A. first started to cooperate with Comarch in 2004. At first it was Corporate Banking solution and hosting services. This resulted in partnership that has flourished for the last 18 years. During that time, Comarch has implemented several different solutions for DNB, that created a whole banking ecosystem.

Back in 2004, DNB approached Comarch to implement a full Corporate Banking system with internet banking for corporate clients, and a data center with managed services. This led to the solution which became iNord Business.

The solution allowed the DNB to assist their customers with unique functionalities, such as corporate banking accounts, loans, deposits, servicing corporate payment cards, or modules for supporting the service of housing communities or the functionality of virtual accounts. The iNord Business platform was intuitive and could be tailored to the requirements of all important DNB customers.

The second challenge that DNB has been facing was rapidly increasing customer database. The solution was the second Comarch system, that was implemented along with Corporate Banking, Comarch Smart Banking for retail customers. With Comarch intense cooperation and support, DNB was able to adjust to the challenges of that time.

Comarch was the market leader in banking solutions in Poland and had a good system. They not only were a solution provider, but also shared with us their market research and knowledge about how it should work. Comarch advisors worked with us to verify DNB’s business ideas and supported us in their implementation.

We selected Comarch to be our factoring provider because the company had a comprehensive solution with all the needed functionalities with hosting services. Using them, we were able to tailor most of the factoring programs to clients’ needs, and each integration could be a separate project.

In 2006, DNB was looking for factoring solution. Because of fine cooperation, they again reached to Comarch. The idea was to combine it with the banking solution in a form of a factoring module, so that customers had everything at hand in one place.

The factoring module was combined with the banking solution so that customers had everything at hand in one place. On the part of the bank’s employees, the DNB client advisor application provided the functionality of a very detailed management of client rights and transaction limits assigned to accounts; it also allowed to configure multi-person acceptance schemes, which increases the security of transactions.

Most changes were implemented with the agile approach, according to the changing demands of the market and customers; this also solved important legal and regulation changes, e.g. GDPR or split payment relating to VAT. Regulation changes were complicated and forced DNB to act promptly.

Comarch, having market practice, knowledge, and expertise, suggested solutions for DNB and their clients.

On top of all this, with the assistance from Comarch, DNB were able to use factoring solution to discount invoices, which were not included in factoring programs for the bank’s customers. The company’s individual approach helped to adapt systems to the most demanding single customer, i.e. one of the leading companies of pharmaceutical products in Europe.

The partnership between DNB Bank Polska S.A. and Comarch has become stable, but fruitful during this time. 2010 brought the implementation of Comarch Smart Banking for retail customers.

Comarch supported us greatly, because the team showed up with market know-how and offered a solution ready for implementation.

The formats of web services were compatible with other solutions, thanks to which our customers were satisfied with new connectivity opportunities.

Our ecosystem is very competitive on the market. DNB customers find it difficult to find a replacement for our financial services due to the sophisticated integrations of loading files. (…) I think the speed of action, individual approach, flexibility, and efficient implementation of projects are what our customers appreciate the most.

Comarch have been approached to help with transaction protection within the corporate internet banking platform. To secure the bank’s infrastructure from cyber attacks, DNB started using Anti-DDoS (Anti-Distributed Denial of Service protection) from 2016 onward.

In 2017, in order to increase security, DNB have provided customers with a hardware authorization solution, Comarch hardware tPro tokens, which significantly reduces the risk of making unauthorized transactions. This Comarch-original solution and device is integrated with the corporate banking system; it’s a USB token used mainly to authorize online transactions.

The tPro ECC solution is a proprietary hardware token based on the power of elliptic curve cryptography, which currently is the most efficient cryptographic system on the market. The token is additionally equipped with the patented HPD (Human Presence Detection) mechanism, which makes it resistant to any remote attacks. Each authorization requires the user to press a button on the device casing. Apart from security, the other crucial element was to automate customers’ processes. To make it happen, DNB implemented Comarch Data Connect, which the bank calls Web Services. The solution serves to communicate different ERP systems with the corporate banking platform.

Thanks to the implementation of DNB Web Services and the processes’ automation, customers can work in their ERP systems, which are directly connected to the Internet Banking platform.

Over the years, DNB have employed a number of Comarch solutions, which finally has become a whole ecosystem delivered by Comarch. On top of that, DNB have constantly added new solutions. The ecosystem is a reflection of DNB and Comarch’s cooperation, and it has developed according to market changes and customer requirements.

This became even more evident in the most challenging of times. During lockdown, a new, demanding client turned to DNB and the situation required a non-standard approach. At this unexpected project, Comarch assisted in analyzing the case and came back with a much simpler solution than the one that the bank considered. This once again proved the strongness of the bond between the two.

DNB Bank Polska S.A. has been present in Poland since 2002. DNB Bank Polska is the part of DNB group – the leading Norwegian financial group. The group has strong long-term credit ratings of the largest and most reputable rating agencies in the world (AA- from Standard & Poor’s, Aa2 from Moody’s). The group provides banking and financial services in 19 countries. DNB has offices in the world’s major financial centers, including London, New York and Singapore, and its shares are traded on the stock exchange in Oslo and London.

Tell us about your business needs. We will find the perfect solution.