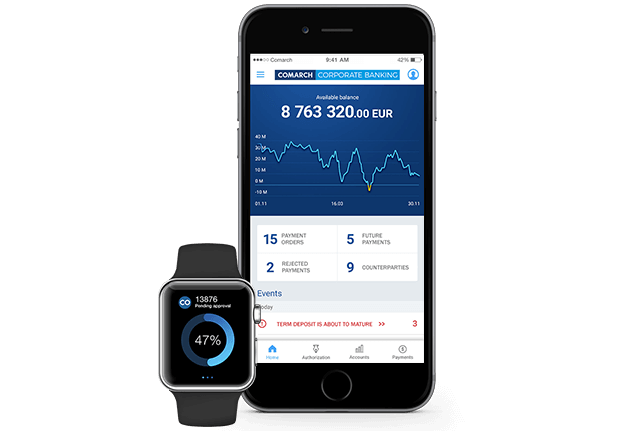

For us, the most important factors of IT projects are innovation, consistency and predictability. Comarch is a proven, reliable partner with vast potential and highly competitive products. What is also significant, Comarch as a banking and finance market consolidator has extensive experience and know-how which brings real added value to projects carried out for the bank. The signed agreement gives us great flexibility in adapting to changing business needs and helps shape our future partnership.

Mariusz Bondarczuk - CIO, ING Bank Śląski, bout Comarch banking solutions