Comarch Life InsuranceCreated with a passion for IT and years of experience, allows the insurer

Comarch Life InsuranceCreated with a passion for IT and years of experience, allows the insurer

to optimize and grow all aspects of life insurance

Created with a great passion for IT, and many years of experience, the software allows the insurer to optimize and grow all aspects of life, pension and health insurance.

Comarch Life Insurance software handles all areas of individual and group life, pension and health insurance. As part of the insurance software products and thanks to its modular structure and unique flexibility, the system can be tailored to an individual customer’s needs and requirements, including the individual life cycle of business processes and the specific nature of a particular insurance company.

Software designed for insurance companies

Quick adjustment to market changes with flexible and configurable tools

Process-oriented solution ensuring a high level of automation and more efficient task management

Modular architecture, proven technology and the SOA approach delivered by a highly experienced team

New perspectives and possibilities to expand a worldwide business

Owing to its flexibility and parametrization abilities, the product definition module allows for:

This approach significantly reduces the time needed to implement a new product in the Comarch Life Insurance system by the insurer without the system provider support.

The Fund management module is responsible for handling various fund type operations i.e. internal/external, open/closed, dedicated and structured. Most of the processes are automated e.g. generating orders and operations, handling corrections. The modules options are, among others:

Comarch Life Insurance handles all processes related to new business and policy administration of life insurance products manually or automatically:

In case of group insurance policies, the system handles operations on group contract level as well as the individual policy level.

This module supports underwriters in their daily tasks in the scope of risk assessment, delivering such tolls as:

The Finance & accounting module is an extension of the Comarch Life Insurance system, supporting:

This module is used for calculating technical provision (reserves) values required by supervising insurance institutions. Besides automatic calculation, the module also allows for the manual modification of technical provision amounts according to the actuary knowledge. The Comarch Life Insurance system calculates:

Moreover, after receiving claims data from the claim handling system, the module can calculate technical provisions for:

Comarch Life Insurance allows for an efficient management of all areas of insurance business, including defining products, offer presentation, underwriting, policy operations, fund management, settlements, reserve calculation and reporting. The life insurance software, offered by Comarch, supports both life & pensions business line as well as local, cross-border and pan-European products for remote and expatriate employees.

Comarch Life Insurance is a platform which can handle any type of protection insurance products with possible extension to health insurance. In terms of pension insurance, our solution supports both defined benefit and defined contribution products. Additionally, different type of investment vehicles can be supported: traditional, unit-linked, or dedicated ones. All these products can be handled under one group insurance contract.

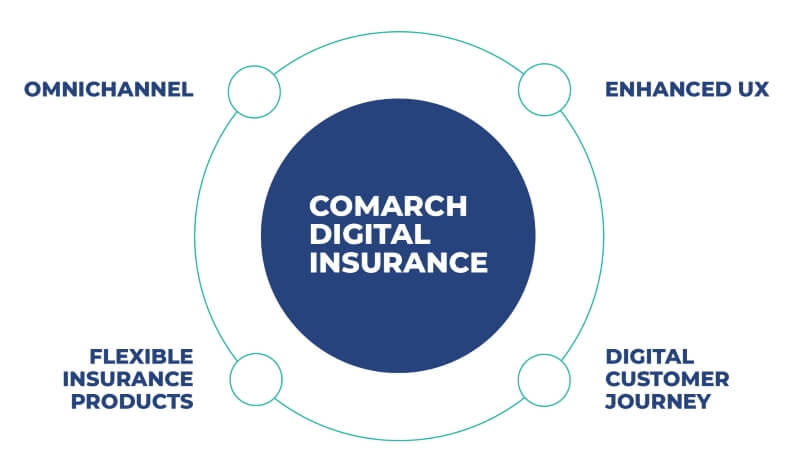

Integrate your software with Comarch Digital Insurance, an omnichannel front-office solution.

It consists of three applications based on one common business logic engine. These are dedicated to distributors, business administrators and end customers.

Take your policy lifecycle to the digital world:

Manage customers and tasks, monitor sales effectiveness, create reports and offer self-service to your customers.

Tell us about your business needs. We will find the perfect solution.