The Comarch Asset Management system is targeted at investment and pension funds, asset managers and insurance companies. It supports the processes of asset management, fund valuation and bookkeeping, as well as portfolio risk and performance measurement and regulatory reporting.

Our solution can be used by:

Banks and other financial institutions

Automation of tasks related to order and portfolio management

Real-time portfolio control in terms of asset allocation, composition and compliance with investment strategy and limits

Increase in the efficiency of portfolio managers through automatic adjustment of fund structure to defined targets

Recording of all investment processes and actions; storing all necessary data for internal and legal reporting purpose

Flexible performance and risk analytics helping to identify best and worst investment areas

Individual approach to portfolio valuation depending on types of securities

Advanced compliance module automating investment limit control as required by regulator or investment team

Support for staying in line with regulatory requirements in terms of reporting, compliance, valuation or accounting rules

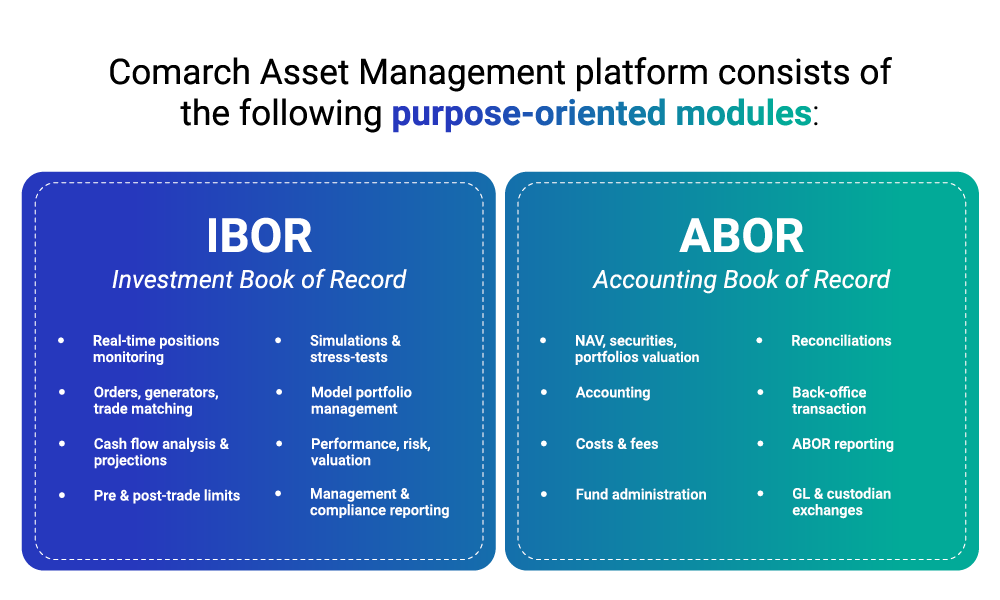

The solution is fully modular, which means we can adjust the scope of functionalities to your specific needs. In particular, during the project it is possible to focus the efforts solely on IBOR, with all the required seamless integrations. That ensures flexibility and quick-to-deliver projects.

Moreover, our extensive +30 years of experience in the capital markets area brings valuable know-how to the table. The platform is highly configurable – therefore in most cases one can adjust processes to the specific needs without system customizations.

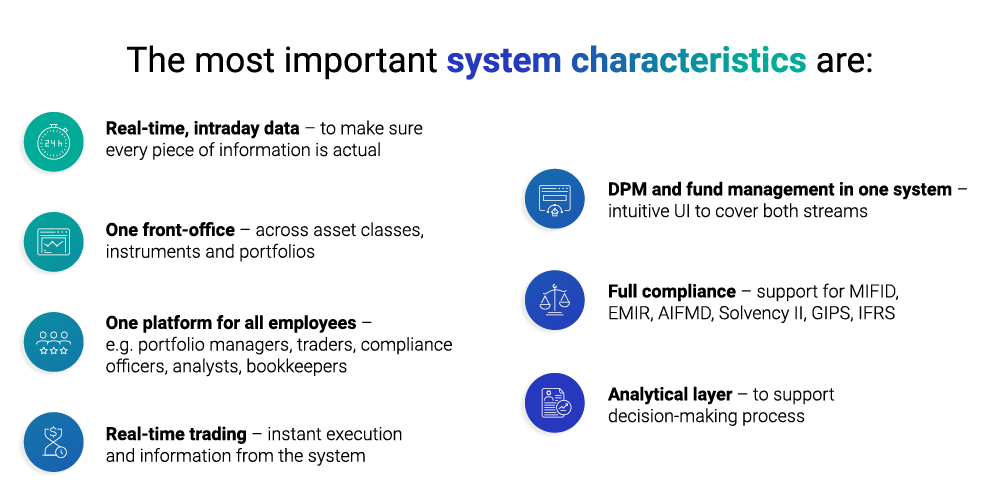

The Comarch Asset Management system offers a set of features supporting end-to-end asset management and facilitates front-, middle- and back-office operations. The platform itself is highly configurable, which makes it possible to tailor processes and algorithms to particular investment philosophies and a wide range of supported portfolios, user profiles and funds subject to different regulations and regimes. A significant strength of the Comarch Asset Management software is its performance and risk measurement capabilities.

The Regulatory & portfolio reporting module supports the reporting processes associated with obligations specified in the UCITS, AIFMD, MiFID and Solvency II regulations.

The individual components of the Comarch Asset Management system are targeted at different groups of users:

Tell us about your business needs. We will find the perfect solution.