ING Business

ING Business

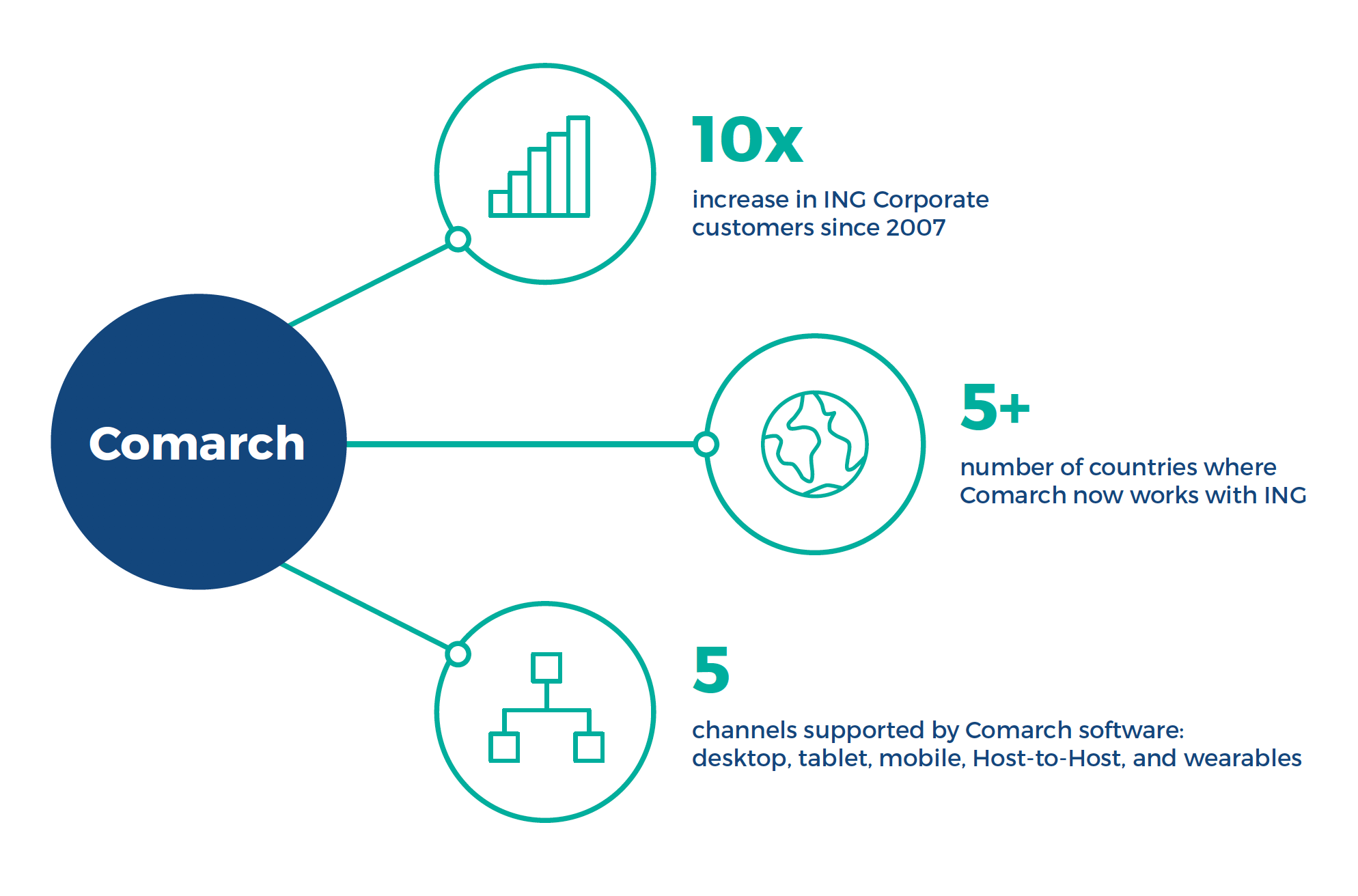

case studyING first chose Comarch’s specialized Corporate Banking software in 2007.

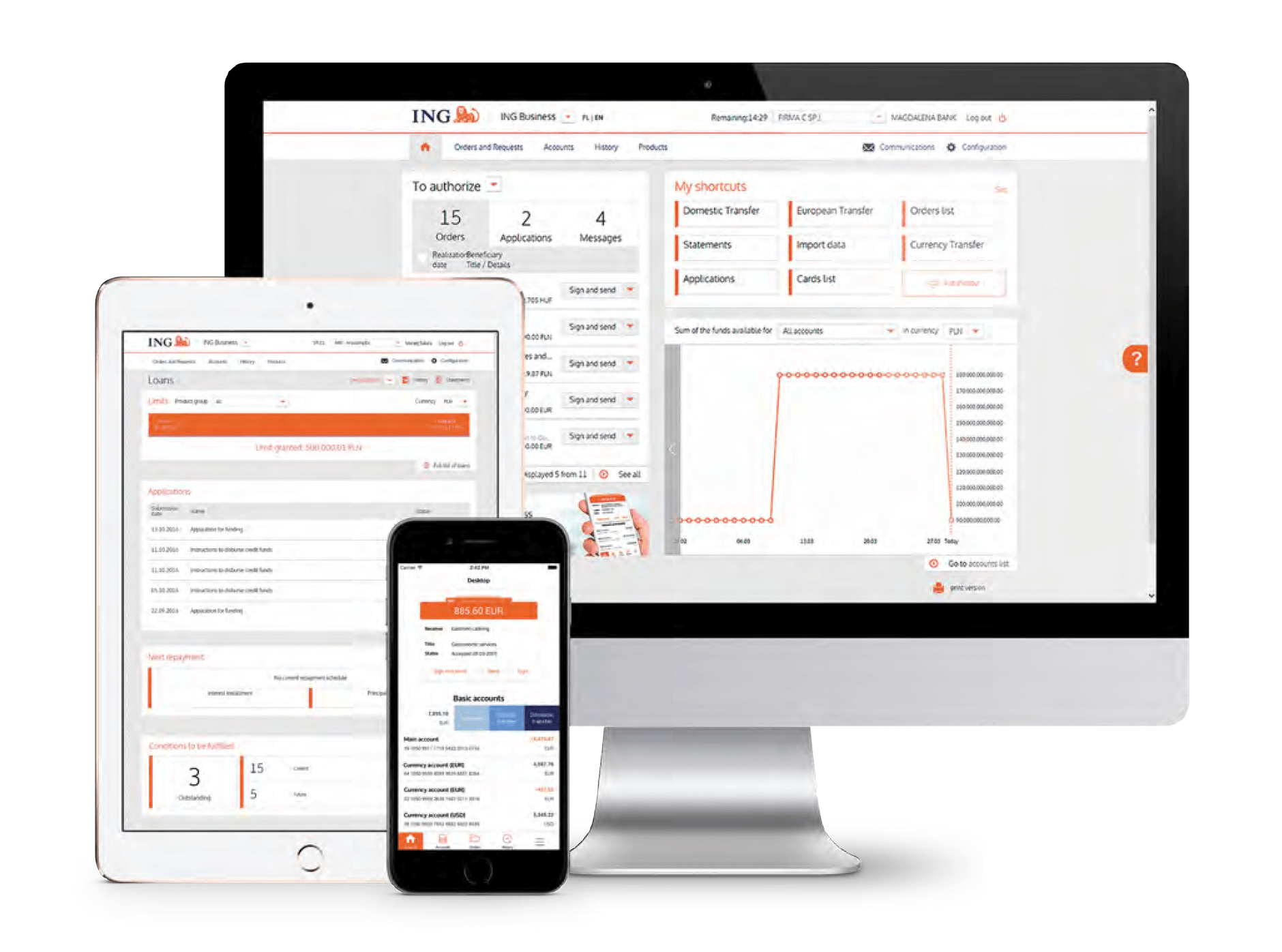

ING first chose Comarch’s specialized Corporate Banking software in 2007. After strong initial success, ING began implementing a new Comarch platform with a completely redesigned UX and new features in 2014

To speed up this new implementation, development was switched from waterfall to agile, the Comarch team embedding with the bank. This faster, more responsive development approach enabled the latest version of Comarch’s software to be available to ING clients in 2016.

ING’s mission is to help its customers stay a step ahead in life and in business. Despite being one of the world’s biggest banks, ING also pushes to be one of the most agile, making banking more accessible for its 35 million customers worldwide.

When ING began working with Comarch in 2007, the bank aimed to automate the increasing volume of online transactions made by corporate customers. ING also wanted to grow its share of the competitive Polish market by becoming (and staying) a leader and innovator.

Comarch’s Corporate Banking solution deployment gave ING:

Today, ING is a top-three corporate bank in Poland in terms of market share. ING has chosen Comarch’s Corporate Banking solution in Thailand and Romania, and Comarch works also with the bank in Belgium. ING has also showcased Comarch as an innovator at conferences such as Finovate Europe, 2016.

ING is a global financial group providing services in the areas of banking, insurance and asset management.

The bank serves its clients with both retail and wholesale products from medium-sized businesses to global corporations. ING Bank originated in the Netherlands nearly 150 years ago and employs more than 51,000 people worldwide in over 40 countries across Europe, Asia and the Americas. ING Bank Śląski, part of the ING Group, has been present on the Polish market since 1989. With 8,000 employees and over 390 branches, the bank offers services for individual clients, entrepreneurs, institutions and corporates. ING became a major shareholder of Bank Śląski in June 2001.

Comarch Corporate Banking is a multi-channel and multi-product platform used to support corporate clients and medium-sized enterprises. Thanks to applied solutions, modularity and wide customization options, the platform meets the expectations of even the most demanding banks. Owing to its integration capability with the existing bank systems, the solution is a universal, comprehensive, efficient and safe tool which streamlines the management of transactions, automates business processes and reduces business costs.

The system easily integrates with clients’ ERP systems: as a result, companies performing tens of thousands of daily transactions gain an effective tool to automate processes and streamline operations.

Tell us about your business needs. We will find the perfect solution.