Clearance model sooner than later

So far, we have focused on changes due to e-invoicing in particular countries. In some of them, adjustments were introduced gradually, and in others more dynamically. Free choice of solutions made two models the most popular: post-audit and clearance.

The post-audit model

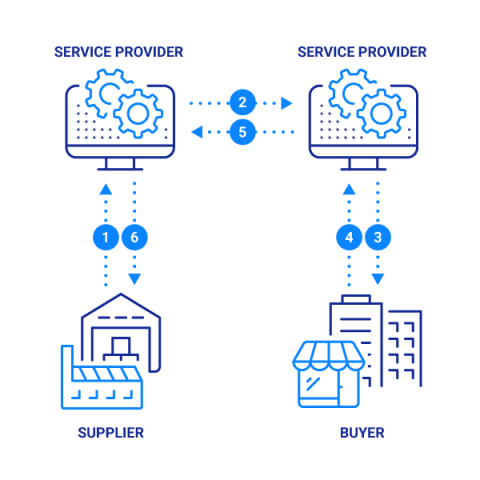

The post-audit model, the most popular in European countries, consists of exchanging invoices or other data between trading partners without involving the authorities in the process, but with the possibility for them to audit the compliance of such processes afterwards.

The clearance model

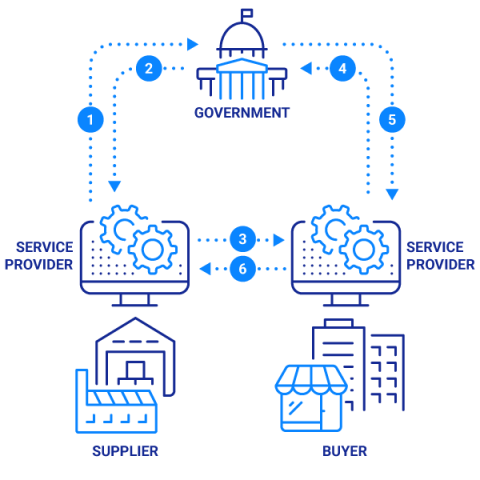

In the clearance model, the most popular in Latin America, tax authorities participate in the process of sending e-invoices. Each invoice must be reported and authorized electronically before or during the exchange process. Much of the data will be transferred to and analyzed in real time or near-real time.

The European Parliament decided to unify the system on the continent. On 10th of March 2022, a resolution with recommendations to the Commission on fair and simple taxation supporting the recovery strategy was made. In the recommendation regarding e-invoicing, The European Parliament calls on the European Commission to:

- Set up a harmonized common standard for e-invoicing across the Union without delay and by 2022 to reduce the cost of the creation of fragmented, different system across the Member States.

- Establish the role of e-invoicing in real-time reporting.

- Explore the possibility of a gradual introduction of obligatory e-invoicing across the Union by 2023, focusing on a significant reduction of costs of compliance, especially for SMEs. Issuing invoices should be administered only via state-operated/certified “system(s)” with full data protection ensured.

- By 2023, examine the possibility that the system will ensure part (or full) tax compliance data/documents for eligible taxpayers, including the responsibility for compliance with these returns (or parts of them), especially from the point of view of reducing compliance costs and risk for SMEs.

It seems that the clearance model is going to be mandatory. In addition, deadlines are short and work will have to speed up.