The number of investment products available for purchase increases every year. But wide product selection may create problems, both for the client and the advisor. The former can get lost in numerous options and refrain from taking any action. The latter may not advise properly – even having specific asset allocation in mind – because it is almost impossible to track every instrument which meets the initial client’s criteria. Overall, choosing the right product at the right time can make all the difference and determine success or failure.

At Comarch, we’ve decided to build an algorithm to address that issue.

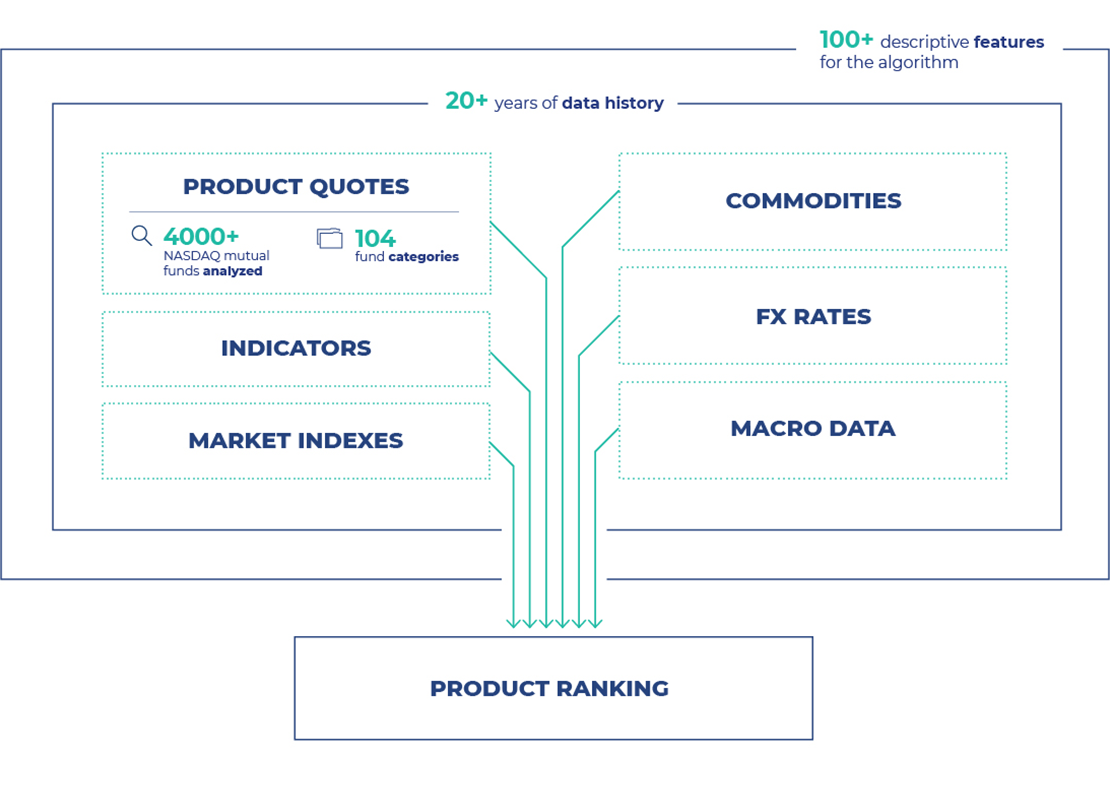

In this vein, we decided to check whether AI-based algorithm can find the best mutual funds using interconnections hidden in product prices, macro indicators, market indexes, FX rates and commodities. The twist was – we did not try to decode these dependencies but rather put them to work and see the actual results in product ranking.

We gathered macro indicators of major global economies (US, EU, China, Japan, LatAm, India), commodities prices, FX rates and major indexes quotations. Then, we employed price history for over 4000 mutual funds traded on NASDAQ. The funds were investing both locally and globally.

Our goal was to create a ranking of the funds and determine which ones would score the highest rate of return in the next quarter.

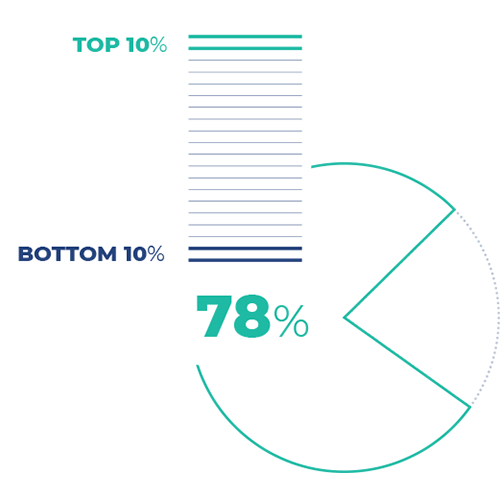

For the results measurement, we came up with a Top-Bottom Analysis. In the analyzed group, we created a ranking of mutual funds, sorted by the probability of achieving the highest rate of return in the next quarter. Then, we moved 3 months in the future and checked whether we were right, especially whether the top 10% was significantly better than the bottom 10% from our ranking.

The actual results for the test dataset went beyond our expectations. The best results we have achieved were 78% in Top-Bottom Analysis. It means that in 4 out of 5 cases we can predict which funds would score a higher rate of return.

Moreover, the difference in rate of return between top and bottom funds amounted to 2,99 percentage points quarterly (12,51 p.p. CAGR). In other words, advisor choosing products for their client from available product universe for one-year period, could count on 12,51 percentage points better returns with the algorithm – no matter how the markets perform.

In almost 4 out of 5 cases (78%) we accurately ranked and selected TOP 10% and BOTTOM 10% of analyzed instruments.

The difference between these two groups turned out to be 2.99 p.p. quarterly (CAGR 12,51%)

Comarch algorithm can indicate candidates for the best performing mutual funds with relevant accuracy.

Since then, we have also tested the algorithm with sets of data different from NASDAQ-specific funds. We have created rankings with AI recommendation engine for Thai and Polish funds, receiving positive and promising results.

Our AI recommendation engine can be applied into wealth management in many ways. One of them is building a model portfolio in a better way. At Comarch, we have tested how well the AI investment approach works, in comparison with standard and well-known methods.

To do that, we have established two scenarios of creating model portfolios:

In other words, we asked a question: “Does AI investment brings significant value when you define a model portfolio?” To run these scenarios, we have selected equity funds from NASDAQ stock exchange. Full comparison between these two methods is in the table below.

| Investment process steps | AI Product Ranking + MPT | MPT |

| Main portfolio assumptions | Manual | Manual |

| Finding best products | Automatic (AI) | Manual |

| Product allocation in portfolios | Automatic (MPT) | Manual/Automatic (MPT) |

| Model updates | Automatic | Manual |

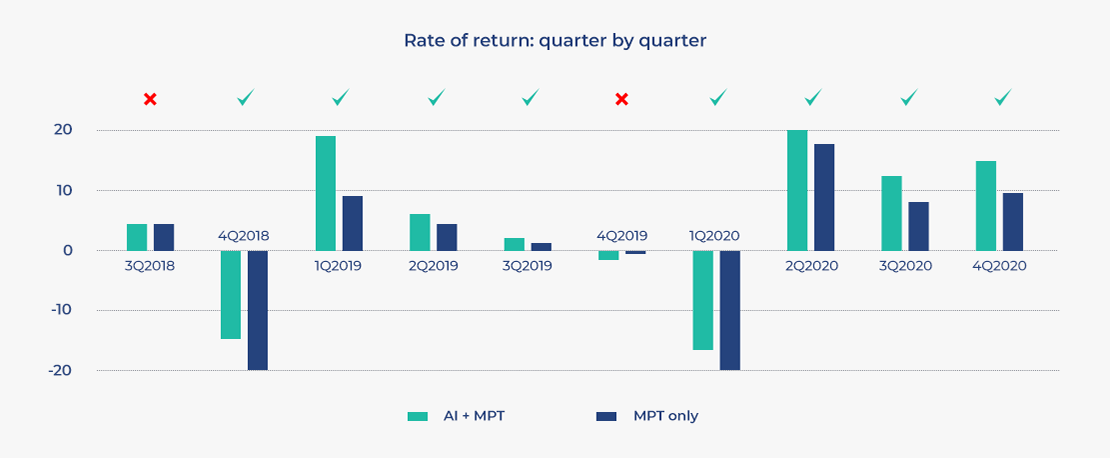

Apart from having more steps automatized with AI investment algorithm, the most important thing is analyzing rate of returns for both methods. To do that, we compared two rates of return:

RoR 1: average rate of return for portfolio created using only “TOP” products from our AI investment algorithm (AI + MPT)

RoR 2: average rate of return for portfolio created using random selection of instruments and weights calculated with Markowitz’s Theory (MPT)

Results of that comparison are in the table below:

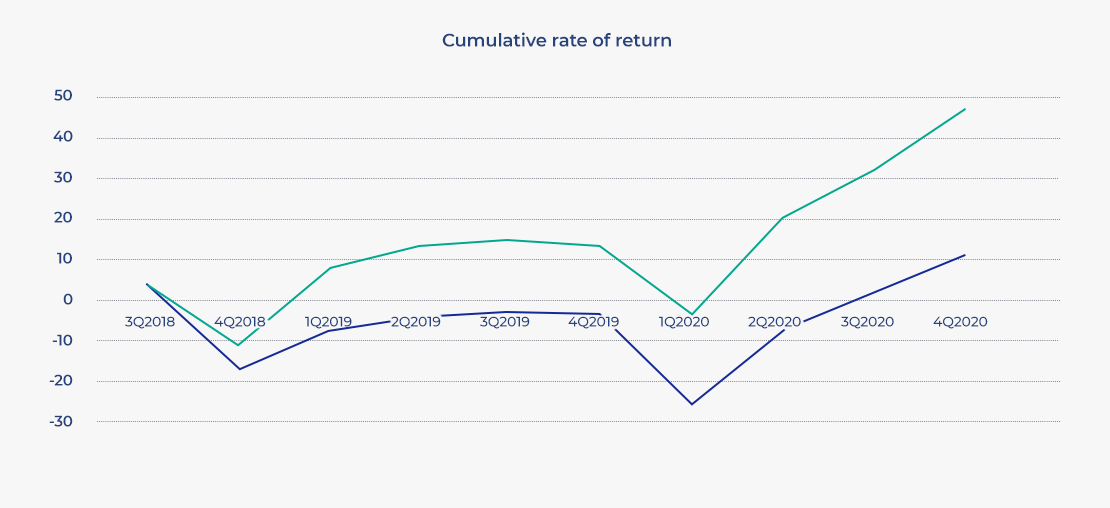

Moreover, we have checked whether using AI algorithm helps with lowering portfolio risk, comparing to regular MPT theory. For that, we’ve analyzed cumulative rate of return and Sharpe indicator for test period of 10 quarters:

Test case: MVO, sample cov, HMR, 0.3 product upper bound.

Test case: MVO, sample cov, HMR, 0.3 product upper bound.

To sum up, our example of use proved significant value from implementing AI investment algorithm in problems like creation of model portfolio for wealth management. Not only AI+MPT brought higher rate of return, but also lowered overall portfolio risk.

That means, it pays off to include AI recommendation engine in your decision-making process.

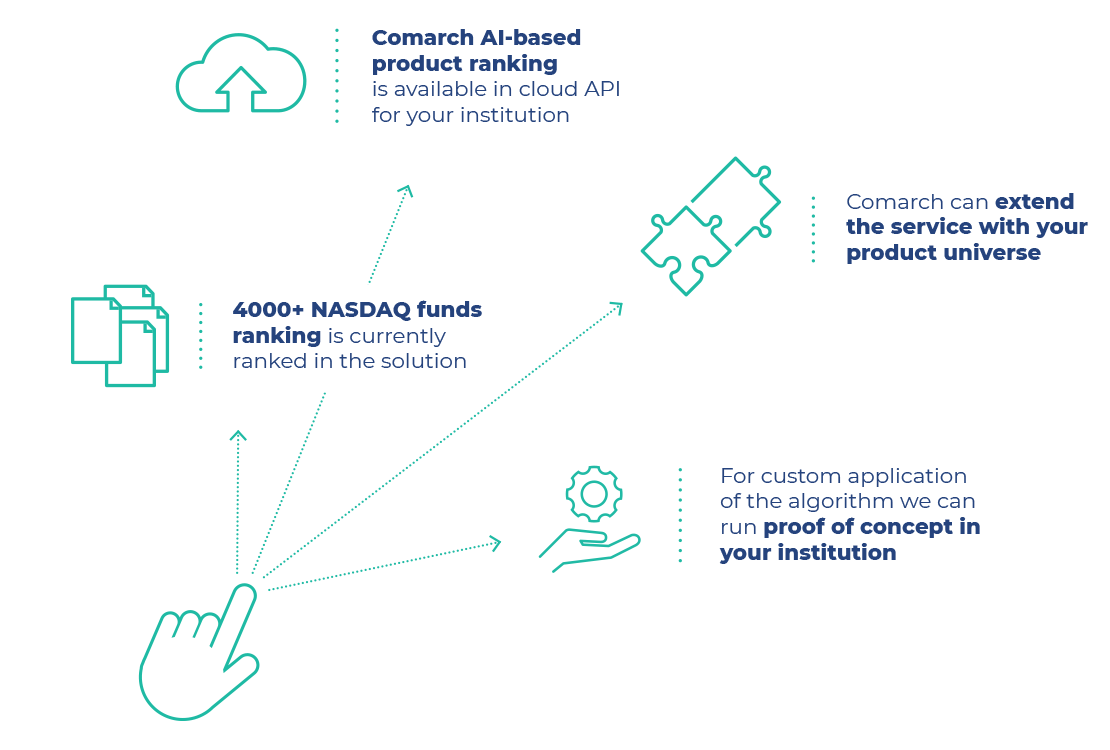

AI Product Ranking is a cloud-based solution, which uses subscription model. You can sign up to our AI recommendation engine the same way you sign up for Netflix. Currently, our AI investment algorithm analyzes NASDAQ funds, but if you are interested in your specific product universe – we can set that up!

Also, there are many ways how we can apply our AI recommendation engine in your institution. If you see a clever way how it may fit in your specific case, do let us know.

Tell us about your business needs. We will find the perfect solution.