Leverage customer experience with robo-advisoryEnhance your wealth services and make them algorithm-driven

Leverage customer experience with robo-advisoryEnhance your wealth services and make them algorithm-driven

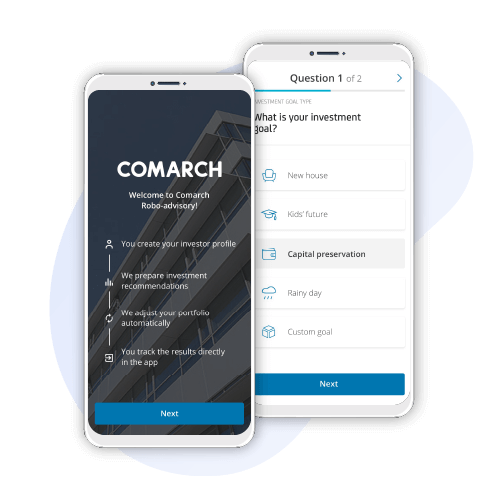

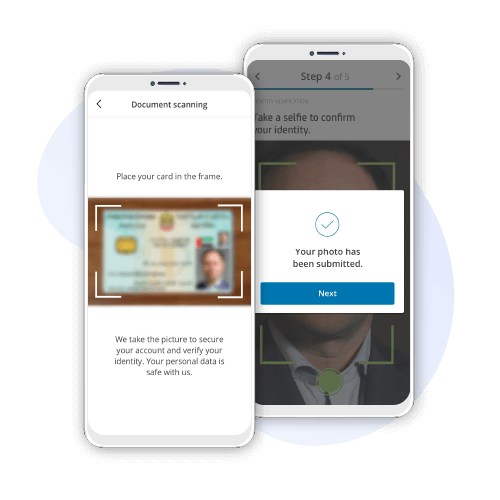

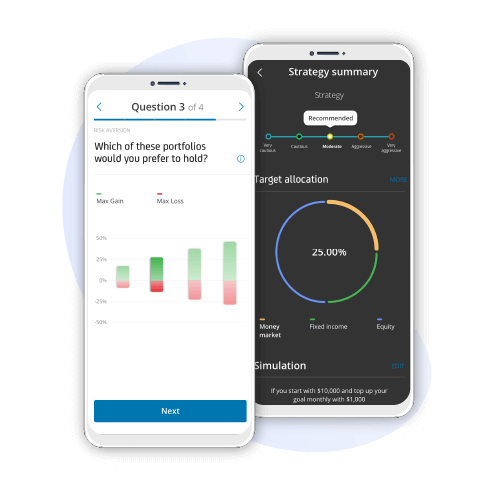

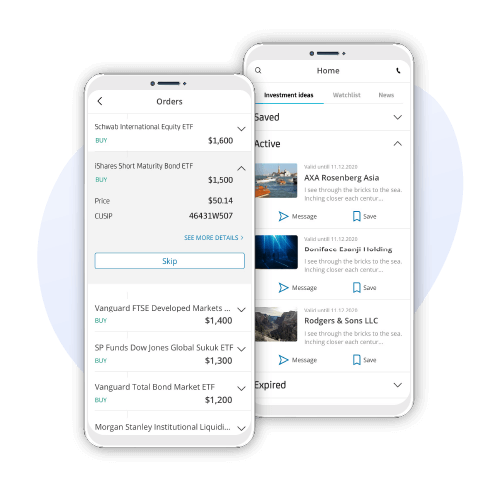

Streamline the customer journey from investment onboarding to execution with the Robo-advisory module of Comarch Wealth Management. The module will help you automate rebalancing and execution processes, as well as maintain full control over product offering, compliance, and suitability limits.

All this is accessed via dedicated applications or API, and integrated with your internal data or external partners. Each setup is country-specific, so there is no need to worry – our robo-advisory will always be in line with each bank’s requirements in terms of investment constraints and compliance rules.

Support your end-clients with self-driven robo-advisory processes and bank-client communication through innovative channels with the use of newest technologies.

Let your business grow by taking client experience to the next level.

Tell us about your business needs. We will find the perfect solution.