Satisfying SME insurance clients in times of pandemic

- Published

- 6 min reading

The protection offered by business insurance is especially important for small and medium enterprises, where one situation can cause severe disturbance to all company operations.

The SME insurance market is now evolving due to a lesson learned after months of pandemic. The majority of smaller and medium businesses have had their finances affected, so insurance products and services they are looking for are more precise than ever before. And, like never before, these products must be purchased digitally.

The increasing size of the SME insurance market

According to the European Commission, “The SMEs are those enterprises employing fewer than 250 persons that have a turnover of less than 50 million euros and/or a balance sheet total of less than 43 million euros.”

And there’s quite a few of SMEs worldwide. McKinsey writes that in 2020, British SMEs accounted for more than 99% of all companies and employed approximately 77% of the workforce. The office of the United States Trade Representative counted 30 million SMEs in the US. These cover nearly two-thirds of private sector employment in recent years.

Small and medium enterprises are an integral part of economy.

Basic coverages for the pandemic

For a long time, the SME insurance market has offered business continuity and disruption policies. In fact, they are one of the key protection areas. Such policies are often included in the general liability insurance package or can be extended separately.

The most popular claims throughout the pandemic in 2020 regarded business continuity among SMEs. Numerous micro, small, and medium enterprises all around the world struggled with decreasing incomes due to the pandemic’s consequences. It was especially businesses connected with leisure that experienced a downturn.

The situation has been problematic for the SME insurance market. On the one hand, there have been lots of aggrieved insured business owners, on the other – policy agreements, terms, and conditions that oftentimes disqualify the global pandemic from claim compensation. Some of these smaller companies have retreated from the market, but some are still trying to make ends meet. No doubt they are more conscious as to what their insurance needs are.

According to GlobalData’s 2020 UK SME Insurance Survey, a lot of companies are concerned about their business during the pandemic because they are dependent on one client. To put it into numbers, 27.9% medium sized enterprises and 24% small ones are extremely worried about their overdependence on a key client. Because policies are bought for risk prevention, the SME insurance market can prepare new offers suited to the current needs of these businesses and perhaps the dangers of losing key clients.

SME health insurance

During the pandemic, businesses realized it would be best to have one more cover or offer for their employees. An unparalleled value or the team is SME health insurance, often referred to as business medical insurance.

SME health insurance is probably more popular or necessary in some parts of the world than in others. For the longest time, the United States has been the most advanced, although tightly regulated market for SME health insurance. It is probably also a good place to be on the lookout for new employee benefits and trends.

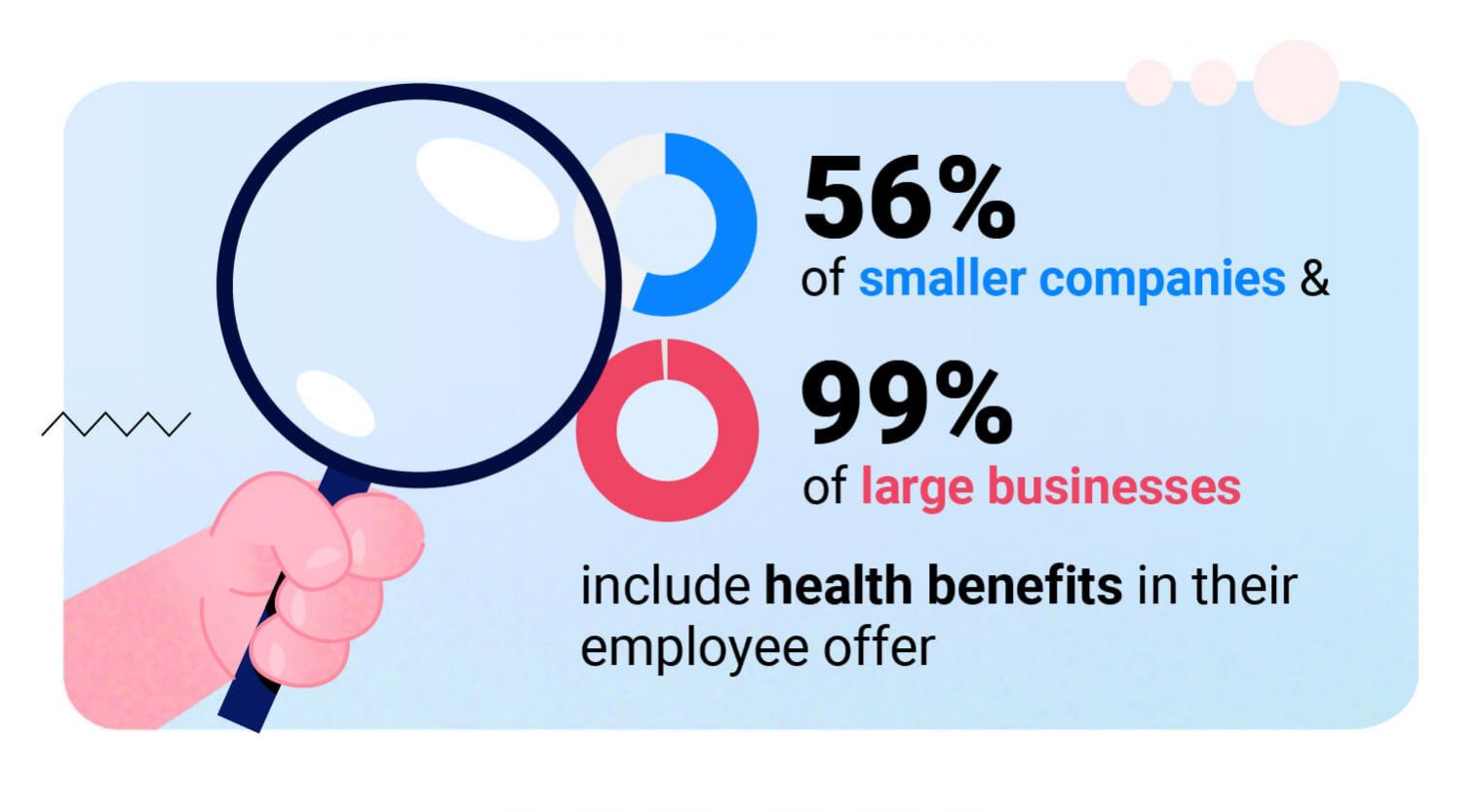

The Kaiser Family Foundation made extensive research on corporate and SME health insurance. In their 2019 Employer Health Benefits Survey, they stated that 56% of smaller companies and 99% of large businesses include health benefits in their employee offer, at least for some of their workers. The interesting thing is that companies of different sizes look differently at split premium payment. For instance, 31% of employees using the benefit of SME health insurance are enrolled in a plan that is fully paid for by the employer, whereas for workers in large companies it is only 5%.

In the rest of the world, especially Europe, corporate and SME health insurance plans are more of an additional employee benefit. Especially in countries with accessible public healthcare, private medical insurance is not yet so popularized. It is more common there to come across travel, dental, or general health plans.

Whether it’s the US, Europe, or Asia, throughout the pandemic people have felt more in need of medical insurance than before. Such attitudes mean a widely open door for corporate and SME health insurance. The market is going to offer a lot of products with different scopes, but a question remains: how will business clients purchase these policies?

The pandemic has influenced this area as well. Agents and brokers now require access to digital tools that will allow them to prepare tailor-made offers and perform all formalities. This kind of sales process is not straightforward, but it can be conducted smoothly with flexible software for the SME insurance market. Even if a few parties are involved in verification and acceptance, all tasks and documents will be sent automatically, and the whole process lead digitally.

SME insurance online

According to the McKinsey Survey on UK SMEs conducted in 2020, there were 3 parameters in selecting an insurance provider that significantly increased in relevance for SME customers between May and August 2020: lowest price, online-service provision, and flexible product coverage.

With the entire business world going online and e-commerce massively growing, SME insurance online is the natural step. And, unlike the corporate world, SMEs want to buy their policies just as easily and quickly as individuals buy car insurance. Yet in many cases SME insurance online is simply a fairytale, because purchasing and managing business policies online can be done only partially.

Opting for SME insurance online isn’t a new thing on the market. Strategy& (part of PwC) have done research on SME insurance online and more in 2017 entitled Global Digital Small Business Insurance Survey. They found out that there is a great equilibrium gap between the demand and supply of selling SME insurance online. Out of 2,100 SME respondents, 24% bought their policy online. However, of the small businesses that stated they would change the provider within 5 years, 48% preferred to go for an SME insurance online purchase. What’s more, there are many new businesses entering the market that are often born digital. Strategy& calculate that companies operating for a year or less have 20% higher chances to purchase SME insurance online.

To comply with the market needs, digital tools are a must. This time they have to be even simpler, as owners are not insurance professionals like agents and brokers. These users have to do as much as possible by themselves, but, once again, many parties will be involved in the further steps. The software used must be strongly integrated with others. Open architecture is a must, and it’s even better when you can have one solution with all these possibilities.

So, what to offer to the changing SME insurance market?

The approach of SMEs to insurance is changing in the today’s environment. The way that smaller businesses are treated and which channels are used for them must be thoroughly thought over.

Considering the products offered, it seems as though it is basic needs, such as the growing concern for health, that shape the market. SME health insurance can be a market influencer of the 21st century. More attention is also paid to cyber protection on the SME insurance market. Another side to these changes is offering SME insurance online. Smaller and medium businesses want to operate online now in order to be able not only to purchase, but to manage their policies fully via the Internet.

These are only some of the new, appealing factors to consider while re-shaping insurance offerings for small and medium enterprises around the world. But, all these changes impact also the way in which insurance is offered and sold.

Comarch Digital Insurance Product Manager