How to identify life & health insurance development factors and stay on top?

- Published

- 10 min reading

It is extremely difficult to predict the future of life insurance and health insurance. The situation is always dynamic, especially as new circumstances keep appearing to alter the anticipated developments. However, it can be expected that the life and health insurance market development will remain stable. Awareness of uneven development dynamics and the ability to recognize specific signals of impending change can help prepare for possible threats well in advance and seize opportunities.

Factors for the development of life and health insurance

The most important drivers for the development of life and health insurance include:

- a gap in insurance cover,

- insurance awareness,

- digitization,

- legal changes,

- investment in research and development,

- globalization,

- global economic situation,

- transformations and social problems,

- climate changes.

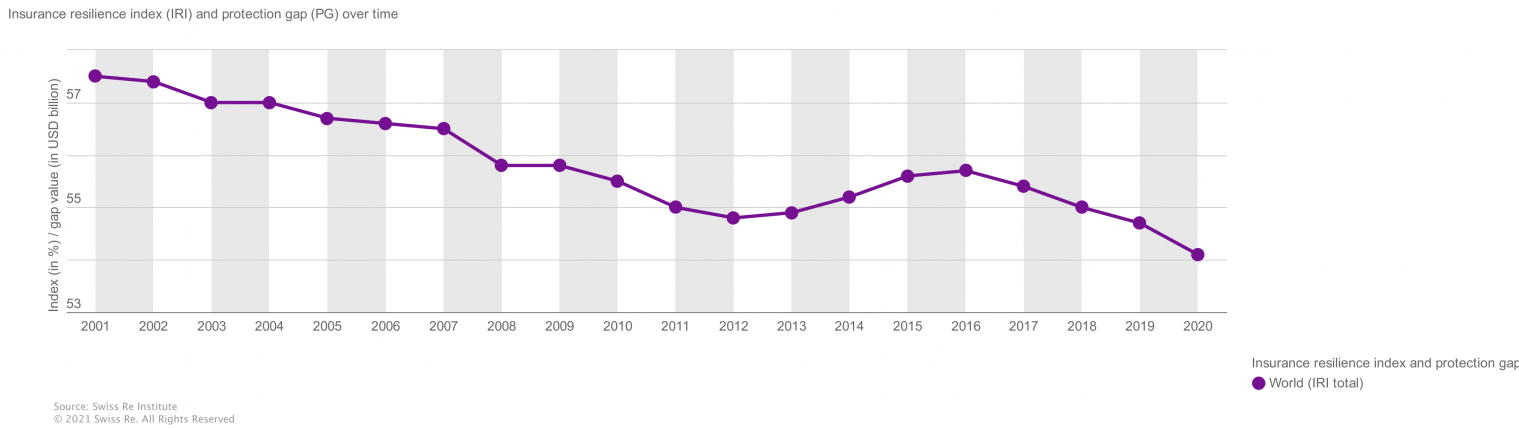

A gap in insurance cover

The Insurance Resilience Index (IRI) has seen another year of decline – this time from 54.7% in 2019 to 54.1% in 2020. This means that the combined global gap in coverage of health, mortality, and disaster risks reached a new record of $1.4 trillion in 2020, with health risks alone accounting for more than half of the total gap ($747 billion, 54% of the total).The widening gap in insurance coverage offers enormous growth potential for insuring the lives and health of customers.

Chart 1. Insurance Resilience Index (IRI)

Source: Swiss Re Institute, sigma 6/2021

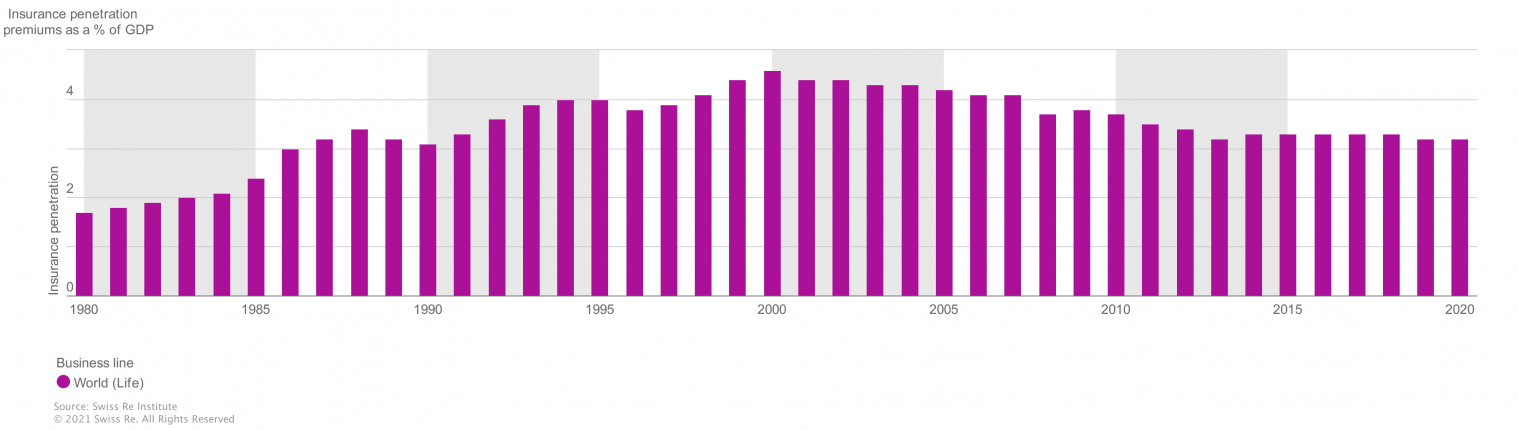

Insurance awareness

The Insurance penetration rate (calculated as the share of premiums in GDP) remained unchanged in 2020 (3.2%).

Chart 2. Insurance penetration rate

Source: Swiss Re Institute, sigma 6/2021

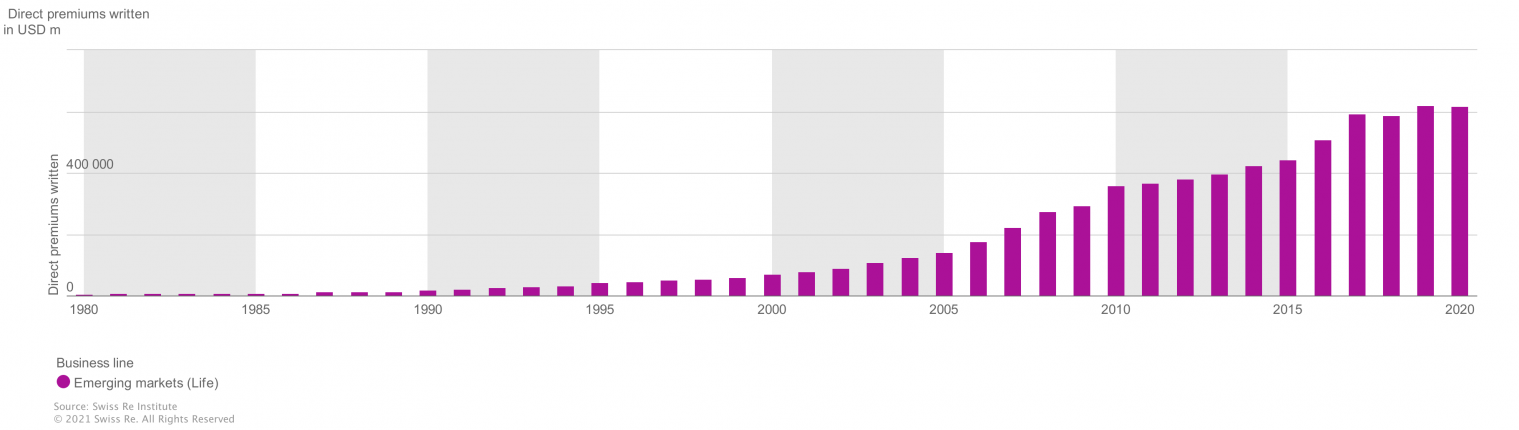

This stability in written premiums was probably a result of the pandemic and increased insurance awareness. Despite the recession, written premiums (expressed as direct premiums written in USD) in emerging markets in 2020 were 5% higher than in 2018.

Chart 3. Written direct premiums

Source: Swiss Re Institute, sigma 6/2021

It can, therefore, be expected that, even in a recession, customers will give a higher priority to protecting their life and health, thereby securing the future of their loved ones.

Digitization

The booming of these insurances has also been influenced by the development of digital tools that, for example, automate sales, make data more accessible or allow processes to be streamlined. One of the accelerators of these changes is the use of artificial intelligence (AI). Widespread digitization enhances the attractiveness and achievability of product portfolios, while the omnichannel and intuitive self-service experience paves the way for customers to access a whole range of services. In turn, agents – through any device and at any time and place – provide advice, make sales and even organize their own work: schedule meetings, or request special conditions. And all this using the insurer's software!

Legal changes

Legislative restrictions on life and health insurance are also increasing year over year. The advantage in the market may be determined by the flexibility of the product offer, responding no longer only to changes imposed by the competition, but also to the growing requirements of the regulatory framework, driven, among others, by the rise of cybercrime and the development of digital tools.

Investments in development

The pace of expenditure on research and development (R&D) does not appear to be slowing down. Indeed, the most recent figures from the UNESCO Institute for Statistics (UIS) indicate that this expenditure reached a record high of almost $1.7 trillion in 2021. The top 10 countries with the highest R&D expenditure (measured as a share of R&D expenditure in GDP) are responsible for 80% of this amount, in the following order: South Korea, Japan, Switzerland, Austria, Finland, Sweden, Denmark, Germany, USA, Slovenia. Such high activity in these markets may indicate only one thing – that these countries are aware of the pace of changes and do not want to fall behind.

Globalisation

Why is it so important not to fall behind? Globalization is erasing borders, creating a single world market where competition is becoming more intense. On top of this, digitalization is taking us into virtual reality. As a result, the continued success of point-of-sale is becoming increasingly uncertain, and its hitherto slow displacement by digital channels has significantly intensified during the pandemic. Such a shift appears to be irreversible.

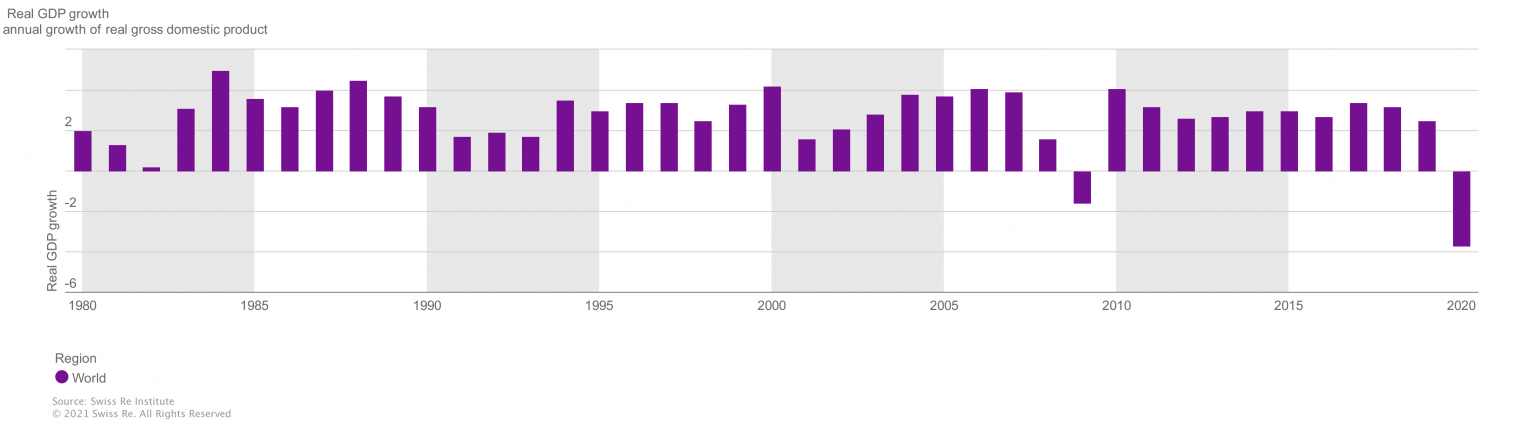

Global economic situation

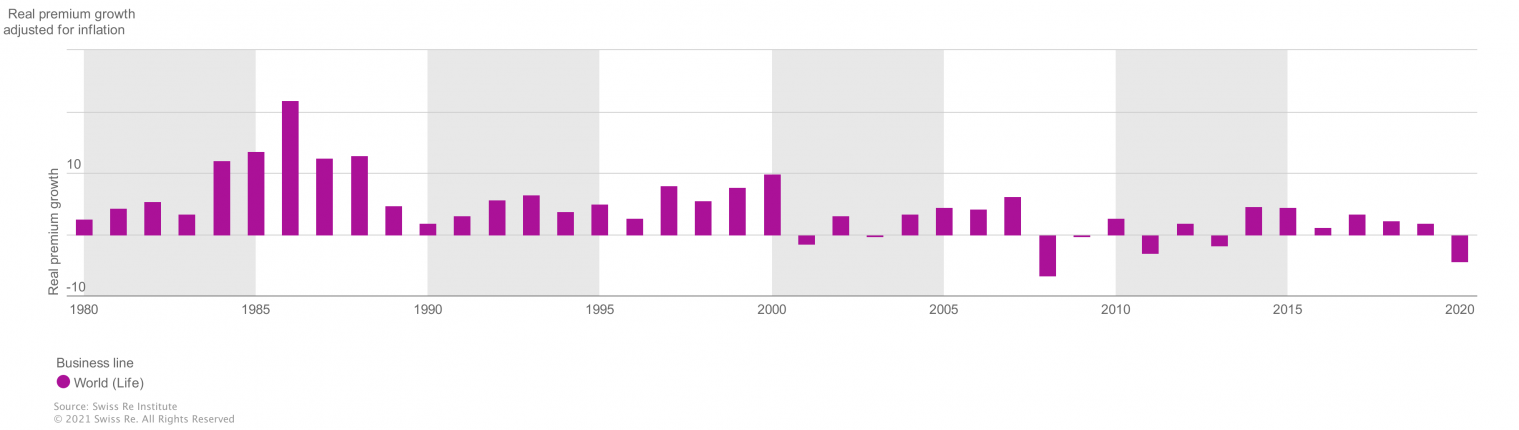

Lockdown, high morbidity and mortality, the healthcare crisis and the global economic slowdown (annual real GDP growth of -3.7% in 2020, lower even than the 2008 result of -1.6%) led to negative written premium growth (-4.4%) in 2020. Since 1980, only 2008 was worse (-6.7%).

Chart 4. Real GDP growth

Source: Swiss Re Institute, sigma 6/2021

Chart 5. Real growth of written premium

Source: Swiss Re Institute, sigma 6/2021

To make matters worse, due to the pandemic, interest rates were cut virtually across the globe, reducing investment portfolio returns and having a direct impact on the life insurance market, disproportionately greater than in other markets. This shows how sensitive life insurance is to economic fluctuations.

Transformations and social problems

The pandemic has exposed growing social problems. There are more and more people complaining of job burnout, and the phenomenon of mass quitting has reached such proportions that it has been described in 2021 with the term “Big Quit.” There is a growing number of people struggling with mental health problems as well as serious health complications after going through the COVID-19. Lockdown and quarantine have intensified feelings of loneliness and fear. At a time of widespread urbanization and economic migration, especially in developing economies, this has further impeded contact with loved ones and exacerbated already existing problems.

Climate changes

The overall global insurance coverage gap and disaster risks are worsening. And that means that the exposure to risk increases as well. It is estimated that in China, the UK, France, and Germany, the frequency and severity of real estate events due to climate change could increase by up to 90–120% by 2040. This increase in risk in real estate directly affects the safety of customers' lives and health. Insurers are not remaining passive. In addition to internal adaptation processes, they also engage in local and global eco-initiatives, which in turn increases customer loyalty to their brands. This is due to the fact that the future of the planet is of concern to a growing number of people, and the widespread fear of climate change (admitted by almost half of young people – 46%) is pushing people to stand in support of acts of concern.

What awaits us?

The IRI index clearly demonstrates a growing global coverage gap. Pandemic, climate change, and uncertainty about the future economy have sparked greater insurance awareness. Digitization, increased R&D spending and further demands from regulators are pushing insurers to raise the standards of their offerings. Social and economic transformations are redefining the behavior of customers, who are becoming more and more open to new technologies and increasingly willing to take advantage of the benefits of a global economy.

As you can see, there is much to suggest that life and health insurance will not soon become obsolete. There is also no doubt that all the above factors will have a significant impact on the final outcome in the race against the competition. It is therefore worth keeping an eye on them today.

Author: Sylwia Frątczak, Product Marketing Manager