The IT systems of the future must make banks more open to collaboration

- Published

- 7 min reading

Outdated IT systems are preventing the banks from being able to create user experiences that are necessary for their survival. In order to win the battle for customers in the future, new IT systems are needed, that will move banking services away from the bank's glass doors, and onto the customers' mobile screens.

This is the opinion of Seweryn Bąk, Head of Business Development, Comarch Open Platform.

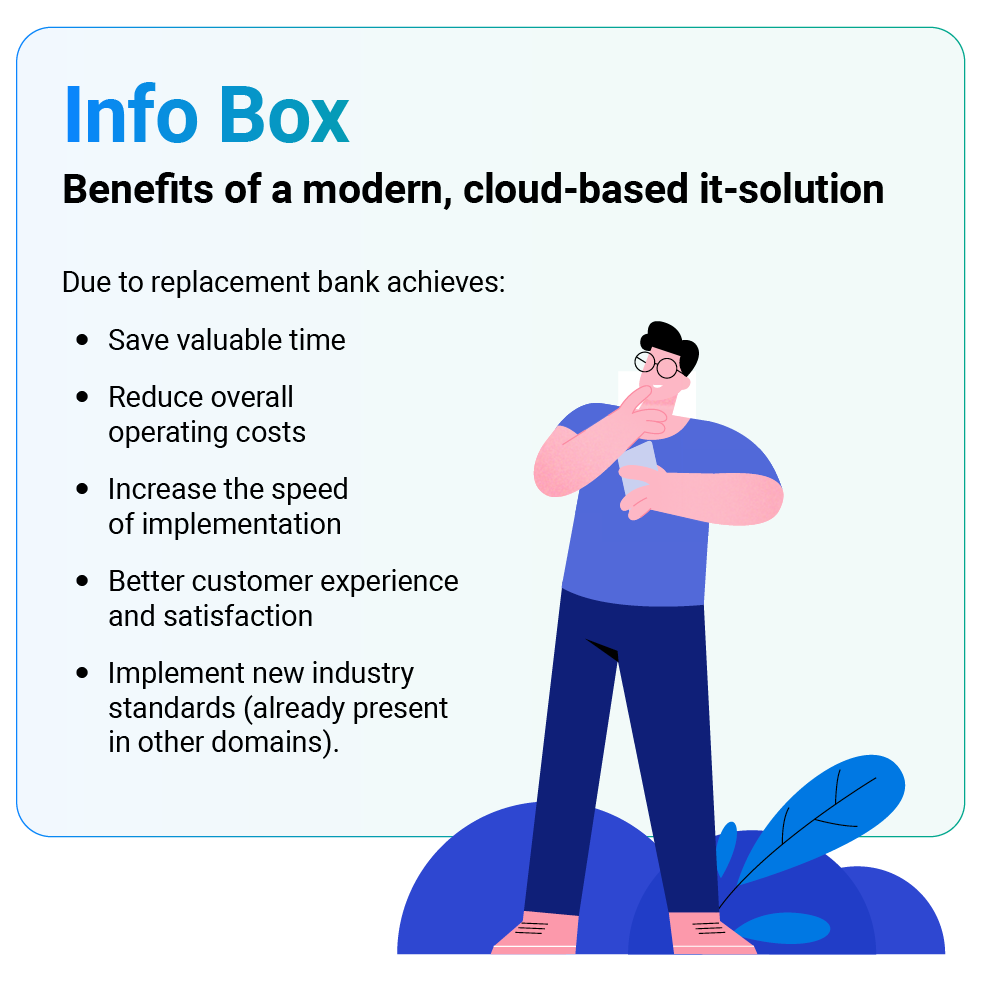

Seweryn Bąk believes that banks should systematically replace legacy systems with new ones that are native to cloud-based IT platforms, successors to the old so-called monolithic applications – the bank's existing IT systems.

"The world is changing, and the market expects new features and services from the bank, and the bank must be able to react quickly to create the best user experiences that are necessary to survive. It requires a different IT infrastructure – a distributed system architecture, or the so-called microservices-style architecture," he says.

Many banks' IT systems are these old-type ones, the oldest of which date back to the 1950s. In some cases, this means that the banks' IT has difficulty being adapted, or integrated, with new channels – for example online marketplaces and ERP systems (financial management systems, ed.) with customers and business partners. It may also mean that the bank has difficulty being digitally present anywhere else than in the online bank.

And that is a problem for the banks, because their future depends on them being able to flexibly enter and exit collaborations, also on the IT side.

Collaborations must be flexible

Thomas Krogh, the Director of Fintech Hub Copenhagen, has a front-row seat when banks want to enter into partnerships with small, financial start-ups – fintechs. The partnerships are an expression of the future of collaborations, but the technology that stands in the way is a real challenge for the banks.

“All financial institutions are on a journey to become more cloud-based. The journey is about being able to act in a new reality with flexible collaborations and openness to new services that can be connected to the bank. A highly modular IT system is required, as opposed to the old, heavy legacy systems." says Thomas Krogh.

In the future, banks thus will be able to – purely digitally – enter into collaborations with smaller fintechs or niche services, which the banks can then integrate into their systems and offer to customers, so that they can maintain relationships with the clients.

Moreover, it means that the banks can move further away from the confines of the branches and onto some of the digital channels, where customers can be met with messages or services. But it also means that the banks must prepare to sometimes be subcontractors to other platforms, and sometimes themselves be the platforms where others are subcontractors.

A cloud-based IT solution is able to better keep up with technological developments, while at the same time being not so heavy and expensive to keep up to date with developments.

"The modular systems can technologically solve the problems of here-and-now, and are also easier to replace with something else, ten years from now. Banks must prepare for a world where everything is more agile and progress happens so quickly that you are put off if you have an old-fashioned monolithic system" says Thomas Krogh.

Lending on other channels

Ultimately, for the banks, it is about being able to maintain the relationships with customers, the relationships that today are challenged from many sides. If a bank customer today e.g. wants to investigate the possibilities of taking out a loan, the person does not have to go out to the physical bank branch or call the bank adviser – but go online to the bank’s webpage, because it is an easy and flexible way to talk to your bank.

Younger generations in particular are getting even further disconnected from their banks – an example is microloans through a "buy now, pay later" service, which they use via their favorite app to buy fast food, clothes or the like, instead of contacting their own bank.

If the banks want to maintain the relationships with their private customers in the future, they must go out and be exactly where the customers are, so they can be the ones offering micro-consumer loans to customers who buy online. Seweryn Bąk remarks:

"Modern IT systems provide the opportunity to be on other channels than just one's own. If the customer has to choose between taking out a consumer loan from a traditional bank or a lending company, in order to carry out, for example, a clothing purchase, most customers will probably want to take out the consumer loan through the bank, because the bank is perceived as much more trustworthy." he says.

"But it requires for the bank to be present, and provide a smooth user experience on the channel where the loan is taken out. And today they are still not necessarily there." he says, referring to the Swedish fintech Klarna, which provides an in-app-based software solution.

Also in the business world, banks must be able to offer to customers without noticeable transitions if they want to maintain the relationship and win the battle between the platforms that is already underway. Many companies use comprehensive ERP systems, which are the backbone of all financial management. If the banks want to prevent the ERP systems from squeezing in between the corporate customer and the bank, it must be able to deliver its services in interaction with the ERP systems that the companies use.

This requires the bank to have a flexible IT platform, says Seweryn Bąk.

"Many ERP systems and the online banking systems are able to do some of the same things. The banks must be able to deliver a better experience that is faster and more frictionless for business users – otherwise the users will use the ERP system that they already work in.”

Legacy systems must be retired

If one has to say something good about the current systems that the banks are using today, it is perhaps that they are what was keeping the banks running for decades. But the demands of the times mean that it is becoming more and more uneconomical to keep them as they are, Seweryn Bąk assesses.

"The very concept of the monolithic system makes it difficult to keep up with development. Most of the employees who really knew the systems have already retired, and it is difficult to update the systems without having to pause everything. It has come to the point in which it has become clear that it is time to retire legacy systems themselves.”

The advertisement was published 12.09.2022 by Børsen Creative (produced in collaboration with Comarch).

The advertisement was published 12.09.2022 by Børsen Creative (produced in collaboration with Comarch).

Autor: Christian Bartels