Risk Management software for banks

More and more customers expect banks to provide very detailed and precise information on credit terms and give decisions quickly. This is the challenge for financial institutions: they must handle as many transactions as possible in a short time and simultaneously conduct careful and detailed credit risk analyses. Financial institutions cannot afford to make more mistakes; under increasing competitive pressure and recent financial market conditions, they have to get it right.

Risk management at bank includes credit risk management, monitoring of active credit agreements, market risk measurement and what-if analysis, debts collecting, scoring and rating. These activities may be optimized using IT software. Here is the list of IT systems which can improve risk management at bank:

Comarch Scoring Engine - a system platform supporting the work of credit analysts in terms of building optimal strategies which rate credit applications and risk factors involved in allocating credit as well as the analysis of a credit portfolio. The flexibility of its scoring definitions and simple integration with the bank systems allows a fast implementation and launch of Comarch Scoring Engine.

Comarch Rating System - a tool which supports the rating of corporate clients. It is possible to use the application to check the rating of transactions. It is fully configurable by bank employees as it does not require programming knowledge. Owing to the high flexibility and integration with the credit process it is possible to change the risk management policy within a few minutes without engaging IT resources.

Comarch Credit Monitoring - the system supports credit agreement monitoring, especially the monitoring of collaterals, payments, agreement conditions as well as the client’s financial situation. Thanks to the built-in mechanisms, it automatically generates cases which fulfill the monitoring criteria, e.g. overdue repayments exceeding 7 days. The system works in the context of the client which means that the monitoring covers all client accounts. Additionally, as the system is based on the Comarch Business Process Management application, it can automatically send the debt to be collected, restructured or the credit conditions can be changed. The system uses functionality of the Printout Management module that can generate reminders within the system for clients (together with a note about which reminder it is) and is integrated with the central printing machine (mass correspondence).

Comarch Risk Management - a system managing an investment credit portfolio risk. It also automates the risk control processes geared toward limiting the influence of the risk factor on elements of the business activity being carried out. It indicates whether the observed fluctuations can be used for investment purposes.

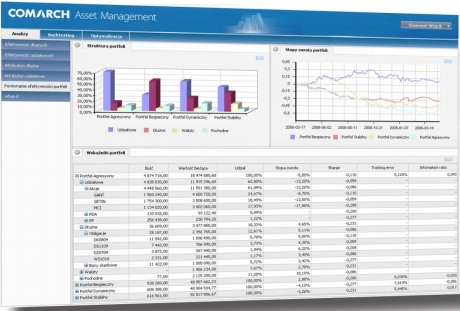

Comarch Performance & Attribution - the system allows an active valuation of the investment portfolios effectiveness, calculating its indicators in terms of benchmarks and risk, an analysis of the profit source attributes and losses, incurred on individual classes of assets, as well as reporting the results of management.

|

Learn more about risk management software >>