A lead commercial bank in Poland was at the stage of operationalizing one joint Small Office/Home Office strategy focused on digital transformation. One of the fundamental elements was the launch of a joint-ecosystem platform aiming at acquisition and loyalization of SOHO customers. It was a complex initiative, planned out to become a game-changer on the Polish market. The bank and their leasing sub-brand were looking for a solution and a trustworthy provider that they could both develop their business with, and obtain competitive advantage with quick business launch.

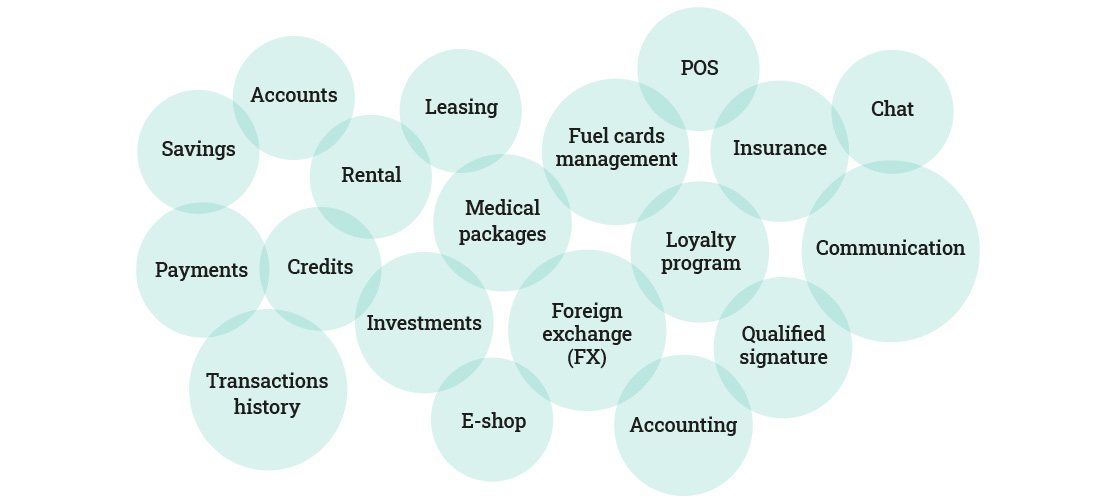

Goal: to select and implement a ready-made solution of a digital ecosystem to acquire and loyalize SOHO customers on the Polish market. The ecosystem sought after was to offer and service financial products of the bank, insurance companies and value-added services (VAS) from other providers.

At first, the bank was discussing an implementation of ready-made products with multiple vendors.

But it quickly turned out that none of the products available on the market can cover the scope right out of the box, and customizations would take too long and cost too much, as the bank wanted to build a solution covering many areas. The additional downside was that the vendors were reluctant to give up their IP rights related to the end result, and couldn’t guarantee additional resources without increasing the price.

As the negotiations were approaching a standstill, Comarch suggested another approach, one that has worked before with other banks undergoing such complex, transformative projects, like ING and BNP Paribas, and who decided to go with Comarch. The approach was the implementation of Comarch Open Platform that was made to combine the best of both worlds – buying ready-made software and building parts of the solution by themselves.

The bank was reluctant at first – as they were originally looking for an out-of-the-box solution that they could get to the market ahead of their competitors. As it turned out, the project schedule proposed by Comarch would actually be able to meet the strict deadlines the bank wanted, while at the same time the bank would be getting much more value than it would be otherwise – in the form of numerous tools, libraries and helpers geared towards efficient self-development.

Unlike the monolithic digital banking solutions offered by various vendors, Comarch Open Platform is a completely cloud-native system based on microservices, to give technological advantage and speed to market that can only be achieved by multiple teams working on the solution in parallel. This was well in-line with the bank’s long-term strategy of having full ownership of the used solutions, in order to avoid potential vendorlock issues.

By partnering with Comarch, the bank achieved much more than they were expecting – instead of getting a system heavily tied to the vendor, they have got an open-development platform that they were able to shape into an ultimate solution that would delight their clients in the years to come. This gave them the freedom to pursue whichever development direction they chose. The kind of lock step dance that would otherwise limit their creativity was now gone, and they were free to make quick and cheap bets on emerging trends, allowing them to exploit the volatile nature of the consumer market.

We are pleased with the client’s very mature approach to project management. Agile methodology and working in multiple streams in parallel allow to take full advantages from the usage of microservices-based architecture. In general, we can see that the technology aspects and IT’s voice are of great importance in the project. In our opinion, this is confirmation of the shift we are currently observing on the market, i.e. increased cooperation on equal terms between business and IT. Even more worth emphasizing is that the client is directly involved in building the solution by using its own internal IT resources. Self-development is currently a trend that fits perfectly

into our model of delivering solutions to the clients.

Whether it’s a replacement of an existing solution, or an implementation of a completely groundbreaking new initiative, a good foundation is a must. It is great to see yet another global bank choosing Comarch Open Platform as a base for its future development, only highlighting that financial institutions are convinced that internalizing development with the help of advanced tools is the best way to leapfrog the competition in technological prowess, which will enable better client engagement and improved business results in the long run.

The main functionalities of the build ecosystem through the Buy-And-Build model collaboration between Comarch, the bank and a leasing sub-brand:

Tell us about your business needs. We will find the perfect solution.