Corporate Business software for banks

Corporate customers need different bank services than individual customers. There are specialized IT systems for banks to handle their requests. The banking software for corporate business includes systems for trade finance, factoring, asset management, custody and deal management.

Comarch Trade Finance – supports the realization of business processes connected to letters of credit, bill collection and guarantees. The Comarch Trade Finance system is a part of the IT solutions used by banks and requires integration with other systems used in the bank. These include the central system, general ledger or data warehouse.

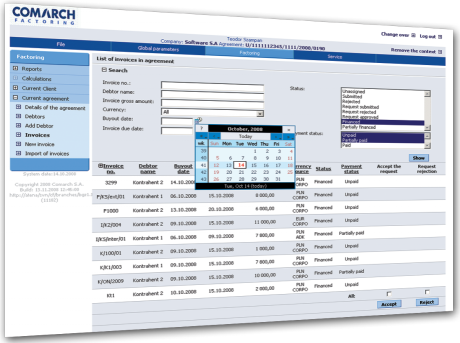

Comarch Factoring – a complex solution geared toward handling of transactions which finance receivables. It handles electronic and paper invoices. The solution is characterized by a large degree of flexibility in modeling the client service process. It allows data concerning the debtor or vendor to be added and defines a financing program.

|

Comarch Asset Management – the system is addressed to asset management companies, bank depositaries, investment and pension funds, insurance companies as well as other institutions which deal with investment activity and portfolio handling. Among others, the system guarantees the modeling of portfolios, handling of orders, access to a current portfolio structure, control of investment limits, filling of transactions and operations on portfolios, valuation of portfolio assets, reports and measures the effectiveness of risk management.

Comarch Custody – the application is directed to banks which deal with the turnover of securities and trustee activity. The system allows for the registration and the financial and numerical settlement of transactions on securities held in the National Depository for Securities and in foreign depositories. It fully complies with the new deposit-settlement system.

Comarch Deal Management – a solution which allows the processing of transactions made on the cash and currency market as well as on debt instruments and derivatives, realized through the bank’s dealing room or by internet banking clients. The tool guarantees a complex handling of the transactional process and accounting services with regards to the filling and valuation of instruments/transactions, the calculation of transactional limits for clients as well as the balance equivalent and adequacy of the transaction in terms of capital.

Learn more about software for banks in a corporate business area >>