Originally, the main objective of the project was to augment the existing set of products and services offered by the bank via internet channel by introducing a new internet banking system for business clients, covering the areas of cash management, trade finance and lending.

The platform to be delivered had to be secure, and all of the services and products had to be accessible seamlessly using single sign-on mechanism. Furthermore, the solution had to provide excellent user experience for the clients.

During the life of the project, the original objective was extended – instead of just delivering missing functionalities, it was decided that Comarch Corporate Banking should completely replace existing front-end solutions for business clients

TMB needed a solution that would allow them to gain competitive advantage on the market. With a solid set of products as a base, augmenting the bank’s internet offering was the logical next step towards achieving that goal.

Piotr Cholewa

Sales Manager, Comarch

When talking about internet banking, ease of use is always one of the top requirements. If the application is not user friendly, it can’t be a success. We knew that we had a great product in terms of usability, but we had to make sure that it was perfectly adapted to the Thai market.

Agnieszka Piróg

Product Manager, Comarch

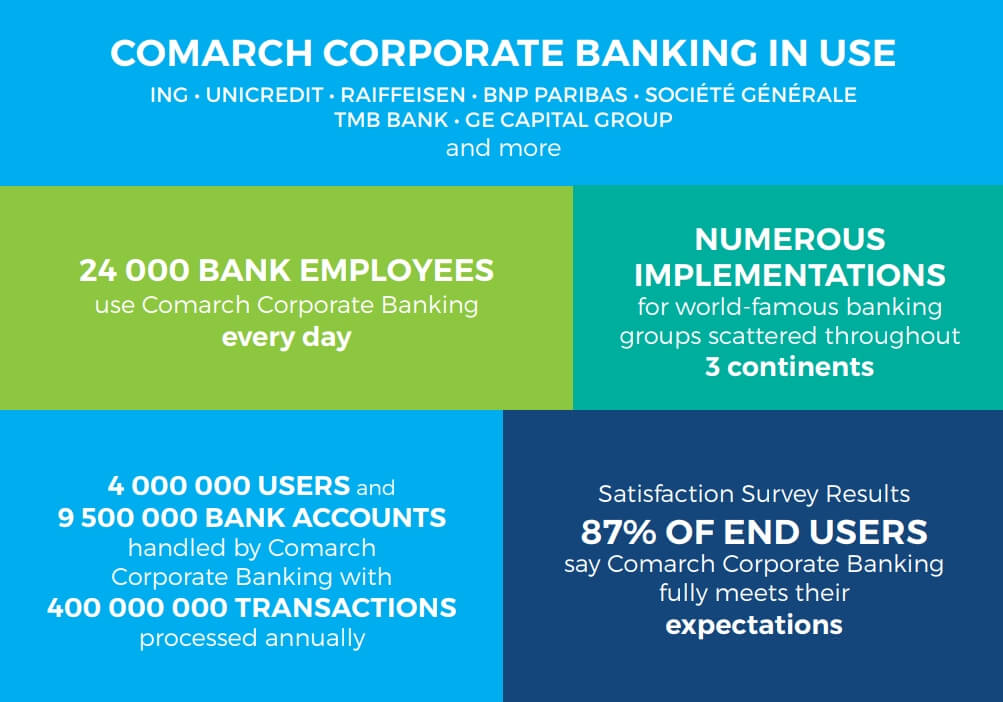

Many banks operating in Thailand use very fragmented internet banking platforms. This means that a customer who wants to access cash management services, and then move to loans or trade finance, often needs to log in to two separate applications. Comarch Corporate Banking encompasses multiple products and services under a single platform, in which the client has easy and uniform access to all business functionalities, regardless of the backend system that provides the data. This makes it much easier to perform day-to-day activities that often require the use of multiple products and services that the bank offers.

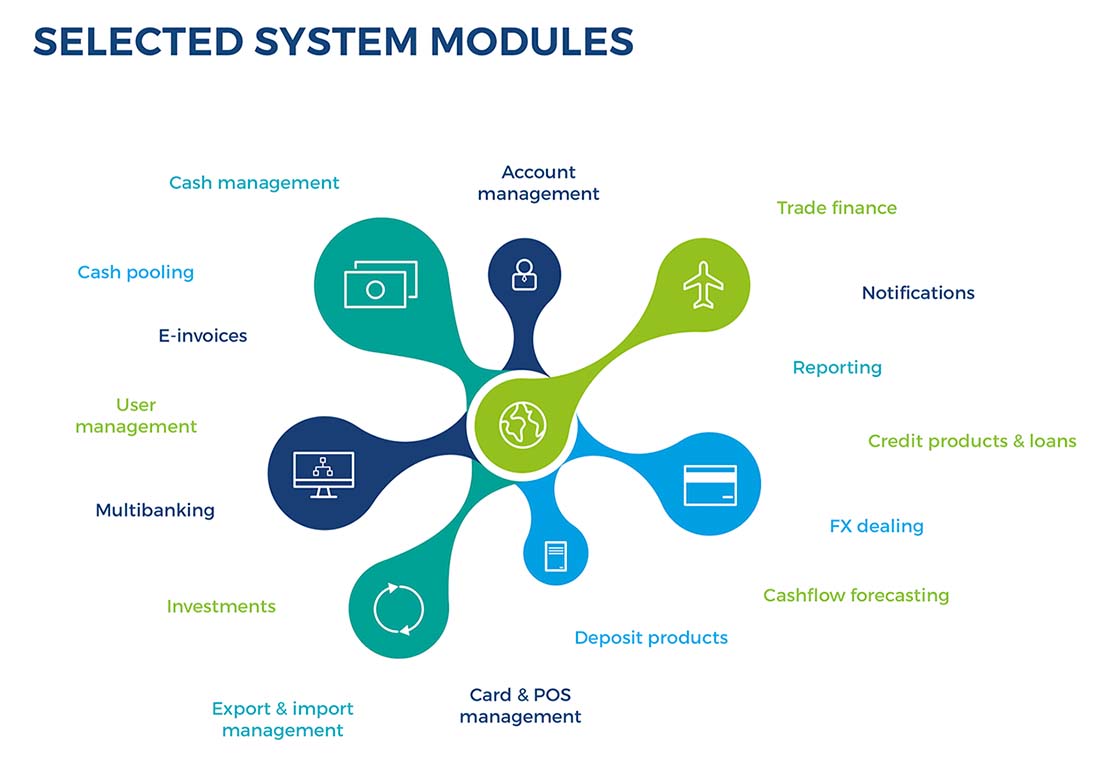

Thanks to modular architecture of Comarch Corporate Banking, essential products and services were made available to TMB Bank clients in just under 10 months. These included Cash Management, Trade finance and Lending modules.

Ever since the initial deployment, the platform has seen steady growth. The subsequent releases included further enhancements to existing modules as well as introduction of new ones, such as EDC (Merchant reports) and FX (Foreign Exchange). Due to extensible nature of Comarch Corporate Banking, new functionalities can be added at any stage of the project.

Thanks to Comarch Corporate Banking, TMB Bank can offer its customers wide range of products and services which are tailored to their needs. The implemented platform reduces costs associated with traditional branch banking, and gives business clients the ability to monitor their financial situation 24/7, in real time. At the same time we can observe significant reduction of fraud risk, thanks to built-in advanced

security mechanisms and approval workflows. Most importantly though, implementation of Comarch Corporate Banking strengthened TMB Bank’s reputation as one of the most innovative banks in Thailand.

Before TMB Bank, we had examples of comprehensive yet quick deployments in Poland, e.g. in Pekao Bank (UniCredit Group). Implementation at TMB Bank proved that we can deliver the same results no matter where the client is located.

Marcin Parka

Project Manager, Comarch

To stay competitive, you need to move forward. Over the years, TMB Bank commissioned multiple changes and extensions to the system, all of which were aimed at delivering more value to their customers.

Marcin Parka

Project Manager, Comarch

Comarch Corporate Banking is a multi-channel and multi-product platform used to support corporate clients and medium-sized enterprises. It incorporates cutting-edge technologies and trends, including HTML5, the Responsive Web Design and Single Page Application approach. Thanks to applied solutions, modularity and wide customization options, the platform meets the expectations of even the most demanding banks. Owing to its integration capability with the existing bank systems, Comarch Corporate Banking is a universal, comprehensive, efficient and safe tool which streamlines the management of transactions, automates business processes and reduces business costs.

The TMB Bank Public Company Limited was the brainchild of Field Marshall Sarit Tanarat. The bank was established to pool widely dispersed all the military funds outside the Country’s budget at the time as well as to provide financial services as an added benefit to military personnel and their families.

Upon resolution of the Cabinet to approve the incorporation of the Bank, ‘TMB Bank, Ltd.’ was then registered on 5 October 1956 with a registered capital of 10,000,000 Baht and 100,000 shares at a par value of 100 Baht per share. The majority of the shareholders were service men both on active duty, those on the inactive list as well as other military units. The initial 4,982 shareholders of the TMB Bank made it the first Thai commercial bank to have a large and widely distributed shareholder base at its inauguration. The Bank has formed strategic alliance with the ING Group in November 2007 and is currently the sixth largest Thai commercial bank in terms of assets.

Tell us about your business needs. We will find the perfect solution.