New generation of mobile banking for business clients

- Published

- 4 min reading

- You must be out of your mind! Do you have any idea what it means to run a business? Loads of capital spent on fixed costs like premises and accountants and all you have right now is a smartphone! – the anxiety haunting entrepreneurs seems sound.

Indeed, companies sometimes do have considerable war chest deposited in a bank just to keep going. Maintaining decent premises, accounting and legal services, IT systems, marketing… They all come with price tags. Soon enough all you will ever need to run a company will be proven business idea and a mobile phone. Seriously.

Office or mobile

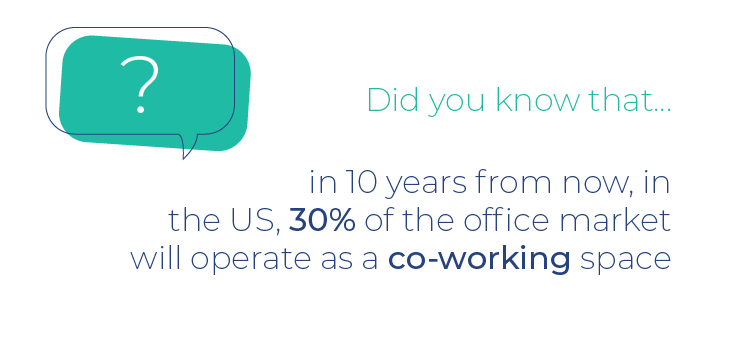

Depending on your business you may pass on physical place – take GitLab for example, they employ 800 people without actual HQ. But say you really need a spot in your business model, think that you can even take up a coworking space in this or another town without having to sign any long-term costly obligations – actually in 10 years from now 30% of office market in the US is to be let this way according to JLL.

Ok, so SMEs become mobile themselves but does it mean they can move around IT hardware, business related documents and still pass for a serious enterprise? And what about favorite coffee mugs – you cannot possible go digital on them, can you?

Yup, there is no real alternative for personal items unlike the administrative essentials, which could as well as be covered by best mobile apps for business. Just take a peek what you could do with mobile business banking from Comarch:

- Banking products management

- Handling accounts, payments, authorization of operations

- Instant financing related with company’s performance

- Cashflow forecasting

- Accounting, invoicing and billing systems

- Booking company’s sales and costs

- Issuing invoices and business intelligence reports

- Client subscription billing

- Communication with clients, suppliers and employees

- Data back-up and exchange of documents

- HR management of employees

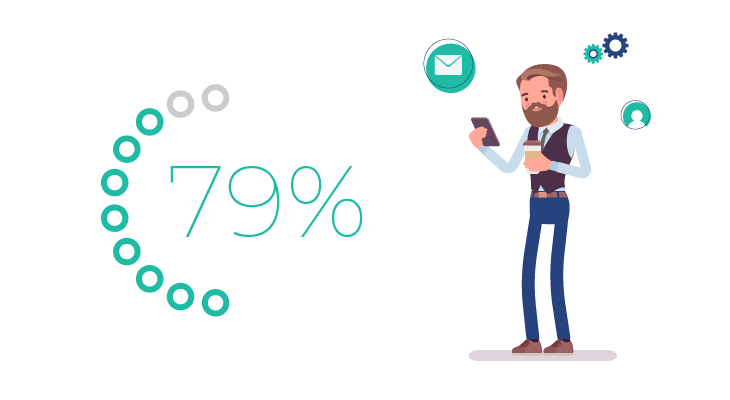

With these features alone SMEs could handle in a smartphone up to 79% of jobs, which according to McKinsey are typically present in this world.

And we are not even halfway through the potential when you can link business mobile banking with external systems through API giving path to completely new set of features and markets for SMEs within this ecosystem.

The best mobile apps for business and where to find them

To be truly free from a administration burden a company should rely on banks, which provide business online banking along with an ecosystem of solutions to support business processes. These banks should also be able to subtly offer just-in-time products and financing as if each SME user was assisted by bank’s employee of the month.

For that purpose banks on their side could either develop themselves relevant pieces of software typically used by SMEs or turn to several vendors to acquire ready-made solutions and integrate them into banks’ systems - both of which seem feasible, yet lengthy.

There’s also a fast lane: selecting a vendor who can provide bank with a ready business banking for small business connected with cloud services to support daily tasks of a company.

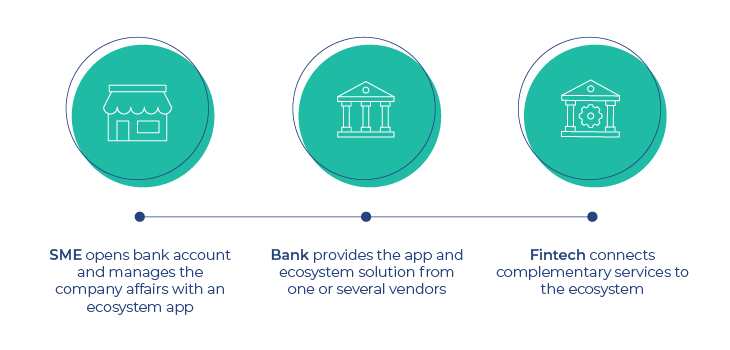

Here’s a model:

A triple win

All in all companies will be able to squeeze routine jobs into a smartphone. From their perspective it’s economic and convenient but more importantly they will focus on things which actually bring cash to P&L.

At the same time banks will acquire new SME business along with tons of precise data for i.a. credit scoring and increasing sales in this segment.

Fintech companies and other third parties connected through API may offer complementary services to SMEs upon bank’s approval.

Bartosz Lerka, Banking Industry Consultant, Comarch